What is Layer 1? A simple explanation for beginners

A solid understanding of Layer 1 is essential if you want to participate effectively in the cryptocurrency investment market. So, what is Layer 1? This article will equip you with the knowledge you need to make smarter investment decisions.

What is Layer 1?

In the world of blockchain technology, Layer 1 is like the foundation of a building. It’s the base layer where all transaction processing and validation occurs. In other words, Layer 1 is the main blockchain, the key network in a cryptocurrency ecosystem. Bitcoin, Ethereum, and Solana are all prime examples of Layer 1 blockchains. So, what exactly is Layer 1?

Layer 1 is an independent blockchain protocol capable of processing and finalizing transactions on its own chain. It has a distributed ledger that records all transactions and a consensus mechanism to ensure data integrity and security. Notably, each Layer 1 has its own native token, used to pay transaction fees and participate in network governance.

Distinguishing Layer 1 from other Layers

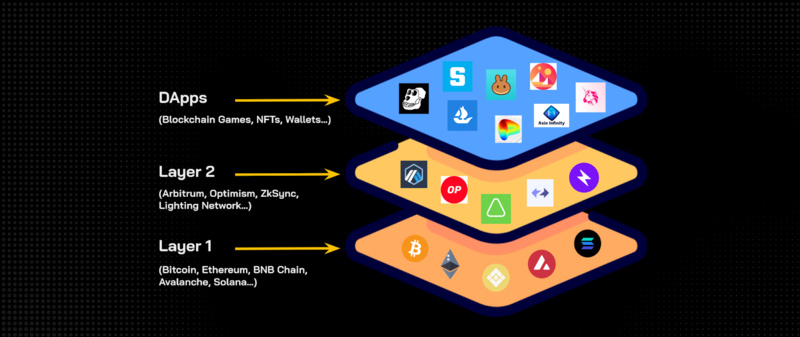

To better understand Layer 1, we need to differentiate it from other layers in the blockchain architecture. Each layer has its own role and function, contributing to a complete blockchain ecosystem.

Layer 0

- Definition: This is the foundational layer, providing the infrastructure for Layer 1 to operate.

- Function: Layer 0 includes elements like the Internet, computer hardware, network protocols, and other fundamental technologies. It doesn’t directly process transactions or store blockchain data, but acts as a base layer for other layers to function.

- Examples: Internet service providers, computer hardware manufacturers, TCP/IP network protocols.

Layer 2

- Definition: A layer of solutions built on top of Layer 1 to enhance network scalability and performance.

b Layer 2 processes transactions off-chain and then aggregates and records them on Layer 1. This helps reduce the burden on Layer 1, increasing transaction speed and reducing transaction fees. - Examples: Bitcoin’s Lightning Network, Ethereum’s Rollup solutions, Polygon.

Layer 3

- Definition: The application layer, focused on user experience and decentralized applications (dApps).

- Function: Layer 3 provides user-friendly interfaces, development tools, and support services for building and using dApps. It interacts with Layer 2 and Layer 1 to access data and execute transactions.

- Examples: Decentralized exchanges (DEXs), blockchain games, DeFi platforms.

In summary

- Layer 0: Foundational infrastructure.

- Layer 1: Main blockchain where transactions and validation take place.

- Layer 2: Scaling solutions that enhance Layer 1 capabilities.

- Layer 3: Application layer focused on user experience.

Each layer plays a crucial role in the blockchain ecosystem. The harmonious combination of these layers creates a robust system that meets the increasingly diverse needs of users.

Core functions of Layer 1

The core functions of Layer 1 can be summarized in three main points:

Transaction Processing

This is the most basic function of any blockchain. Layer 1 is responsible for verifying and recording all transactions that occur on the network. This process includes:

- Transaction Verification: Checking the validity of the transaction, ensuring the sender has sufficient balance and the right to execute the transaction.

- Adding Transactions to Blocks: Valid transactions are grouped into blocks.

- Adding Blocks to the Blockchain: Blocks are linked together in chronological order, forming an immutable blockchain.

Ensuring Security

Layer 1 utilizes encryption and consensus mechanisms to protect the network from attacks and fraud. This ensures that:

- Data on the blockchain is immutable: All transactions are permanently recorded and cannot be altered.

The network is resistant to attacks: Security mechanisms prevent hackers from attacking and taking control of the network. - Digital assets are protected: Users can confidently store and trade digital assets on the blockchain.

Maintaining Consensus

Layer 1 uses consensus mechanisms to ensure that all nodes in the network agree on the current state of the blockchain. Common consensus mechanisms include:

- Proof of Work (PoW): Requires nodes to perform complex calculations to create new blocks.

- Proof of Stake (PoS): Requires nodes to stake their tokens to participate in the transaction validation process.

- Delegated Proof of Stake (DPoS): Users vote for delegates to validate transactions.

Scalability of Layer 1

The Scalability Challenge of Layer 1

Scalability, or the ability to process a large number of transactions quickly and efficiently, is a major challenge for Layer 1 blockchains. As the number of users and transactions increases, the network can become overloaded, leading to serious problems such as:

- Network Congestion: Transactions get congested, leading to long wait times and even transaction failures or cancellations.

- Slow Transaction Speeds: Users have to wait a long time for transactions to be confirmed, impacting user experience and efficiency.

- High Transaction Fees: To prioritize transaction processing during congestion, users are forced to pay higher fees, creating a barrier for smaller users.

Causes of Scalability Issues

Several factors contribute to scalability issues on Layer 1, including:

- Block Size: Each block on the blockchain can only hold a limited amount of transaction data. When the number of transactions increases, blocks become full, leading to congestion.

- Consensus Mechanism: Consensus mechanisms like Proof of Work (PoW) require a lot of energy and time to validate transactions, slowing down processing speed.

- Number of Nodes: The more nodes participating in the network, the more difficult and time-consuming it becomes to reach consensus.

- Transaction Complexity: Complex transactions that require a lot of computation consume more resources and processing time.

Real-world Examples

- Bitcoin: With its PoW consensus mechanism and limited block size, Bitcoin often experiences congestion, especially during periods of strong market growth.

- Ethereum: As the largest smart contract platform, Ethereum also faces scalability challenges due to the rapid growth of decentralized applications (dApps) and the increasing number of transactions.

Consequences of Scalability Issues

- Impact on User Experience: Slow transaction speeds and high fees make users frustrated and limit the use of the blockchain.

- Hindrance to Ecosystem Development: Applications and services on the blockchain cannot operate effectively if Layer 1 is not scalable enough.

- Missed Opportunities: Blockchains may miss out on new development opportunities if they cannot meet the increasing transaction demand.

Layer 1 Scaling Solutions

To address scalability issues, blockchain developers have been researching and implementing various solutions, including:

On-chain Solutions

- Increasing Block Size: Allowing each block to contain more transactions, thereby increasing processing speed. However, this solution can increase storage capacity and require higher hardware specifications.

- Changing the Consensus Mechanism: Switching from Proof of Work to Proof of Stake or more efficient consensus mechanisms like Delegated Proof of Stake (DPoS) can reduce energy consumption and increase transaction validation speed.

- Sharding: Dividing the network into multiple shards, with each shard processing a portion of the transactions, thereby reducing the load on the main network.

Off-chain Solutions

- Lightning Network: Building a second layer (Layer 2) on top of Layer 1, allowing transactions to be executed off-chain and then aggregated and recorded on Layer 1.

- Sidechains: Creating sidechains parallel to the main chain, allowing some transactions to be processed on the sidechain, reducing the load on the main chain.

Examples of Scaling Solutions

- Bitcoin’s SegWit (Segregated Witness): Changes the way transaction data is stored, increasing block capacity and reducing transaction fees.

- Ethereum 2.0: Upgrading Ethereum from Proof of Work to Proof of Stake and implementing Sharding to increase scalability.

Prominent Layer 1 Blockchains in the Market

The current cryptocurrency market is witnessing the development of many Layer 1 blockchains, each with its own characteristics and advantages:

Bitcoin (BTC)

Launched in 2009, Bitcoin is the first and most popular blockchain in the world. With its Proof of Work (PoW) consensus mechanism and a limited supply of 21 million coins, Bitcoin is considered “digital gold,” renowned for its high security, store of value, and pioneering role in the cryptocurrency revolution.

- Advantages: High security, decentralization, widespread adoption.

- Disadvantages: Slow transaction speed, high transaction fees, high energy consumption.

Ethereum (ETH)

Launched in 2015, Ethereum is the largest smart contract platform today. With its ability to support the development of decentralized applications (dApps) and tokens, Ethereum has created a vast ecosystem, including DeFi, NFTs, and GameFi.

- Advantages: Diverse ecosystem, large and growing developer community, scalability is being improved with Ethereum 2.0.

- Disadvantages: Transaction speed is not yet optimal, transaction fees are still high.

Solana (SOL)

Dubbed the “Ethereum killer,” Solana stands out for its extremely fast transaction speeds (up to 65,000 transactions per second) and extremely low transaction fees. Solana uses a unique Proof of History (PoH) consensus mechanism, combined with Proof of Stake (PoS), to achieve superior performance.

- Advantages: Fast transaction speeds, low transaction fees, rapidly growing ecosystem.

- Disadvantages: Has experienced stability issues in the past, decentralization is not as high as Bitcoin or Ethereum.

Cardano (ADA)

Developed by Charles Hoskinson, co-founder of Ethereum, Cardano focuses on security and scalability. Using the Haskell programming language, Cardano is highly regarded for its safety and verifiability.

- Advantages: High security, great scaling potential, development based on scientific methods.

- Disadvantages: Ecosystem is not as diverse as Ethereum, development speed is still slow.

Avalanche (AVAX)

Avalanche is a highly scalable smart contract platform that allows for the creation of custom subnets. With its unique Avalanche Consensus mechanism, Avalanche can process thousands of transactions per second.

- Advantages: High scalability, fast transaction speeds, support for subnet creation.

- Disadvantages: Relatively new, the developer community is not as large as Ethereum’s.

Polkadot (DOT)

Polkadot is a multi-chain blockchain network that allows different blockchains to connect and interact with each other through a Relay Chain. Polkadot aims to build an “Internet of Blockchains” with high scalability and interoperability.

- Advantages: Cross-chain interoperability, high scalability, decentralized governance mechanism.

- Disadvantages: High technical complexity, the ecosystem is still in the development stage.

So, Layer 1 is the crucial foundation, the backbone of any blockchain ecosystem. It ensures security, decentralization, and serves as the platform for basic transaction activities. However, Layer 1 also faces scalability challenges. On-chain and off-chain solutions, along with the development of Layer 2, are contributing to solving this problem, paving the way for a bright future for blockchain technology.

Learning about Layer 1 will give you a deeper understanding of the cryptocurrency market, enabling you to make informed investment decisions. Stay tuned to Solution Of Blockchain for more informative updates on the financial investment market.