What is fantom opera chain? How does Fantom work?

Tired of slow and expensive blockchain transactions? Discover What is Fantom, the high-speed blockchain platform that’s redefining scalability and efficiency. Click to explore how Fantom’s unique technology is powering the next generation of decentralized applications.

What is Fantom?

This comprehensive guide aims to shed light on the nature and functionality of Fantom.

Fantom is an open-source, decentralized platform known for its high scalability, enabling the creation of digital assets (like cryptocurrencies) and smart contracts. These smart contracts empower blockchains to execute advanced transactions beyond simple cryptocurrency transfers, positioning Fantom as a viable alternative to Ethereum in terms of ease of integration and development.

But why the need for smart contracts?

Smart contracts are pivotal in various applications. They are the backbone of decentralized finance (DeFi), enabling financial services without central authority. They also establish ownership of non-fungible tokens (NFTs).

Ethereum, the pioneer of smart contracts, hosts most decentralized applications. However, it faces congestion issues, leading to disruptions and high fees. This has spurred the development of alternatives like Fantom, which boasts faster and more affordable transaction processing.

How does Fantom work?

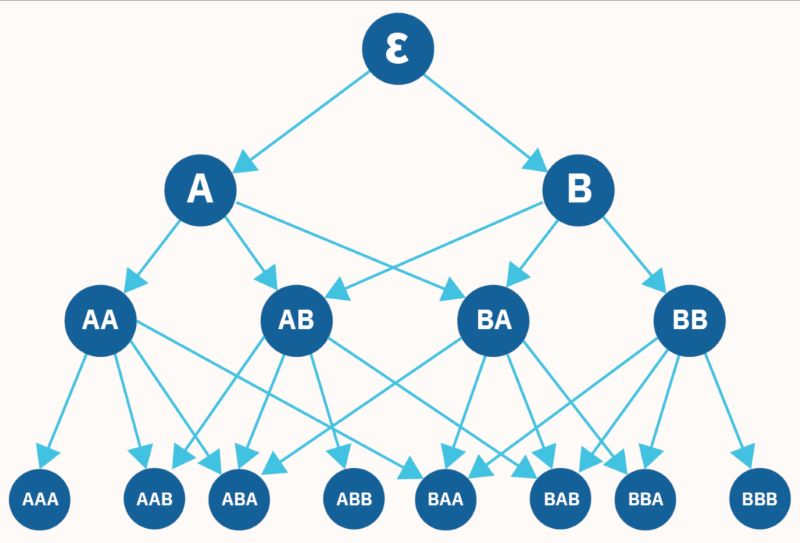

Fantom has two technologies backing it: DAG (Directed Acyclic Graph) and Lachesis. Let’s explore these two key technologies one by one in the most straightforward language possible.

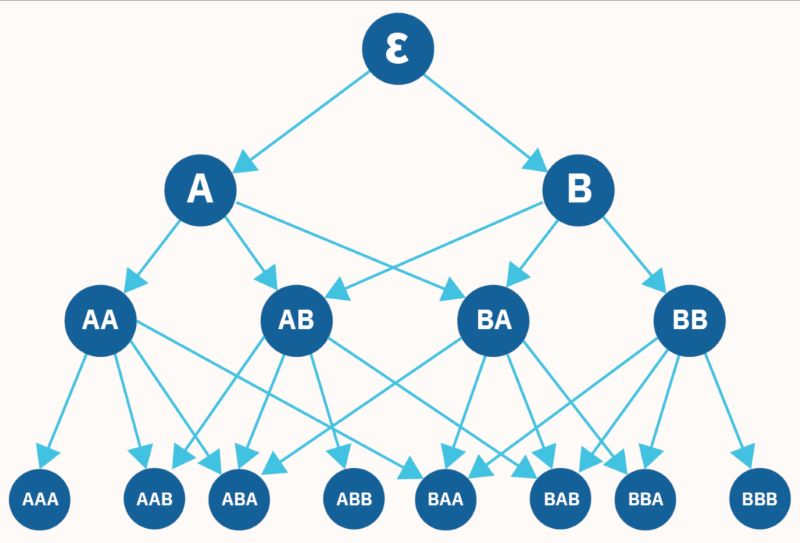

What is DAG?

Directed Acyclic Graph (DAG) is a network of connected nodes where data flows in one direction without revisiting the same node. This structure resembles an ancestry tree, with nodes representing data storage points and directed edges indicating the flow of information.

Please remember all DAGs have the following:

- Nodes (places to store data)

- Directed edges

The nodes exchange data. The first node is where it begins. Think about ancestry trees: those are DAGs.

And what about cycles?

- The graph is cyclic if the information moves through the network without returning to the same node more than once.

- On the other hand, an acyclic graph doesn’t have any cycles. The information can only get back to the node if you go through the same node more than once.

What is Lachelis?

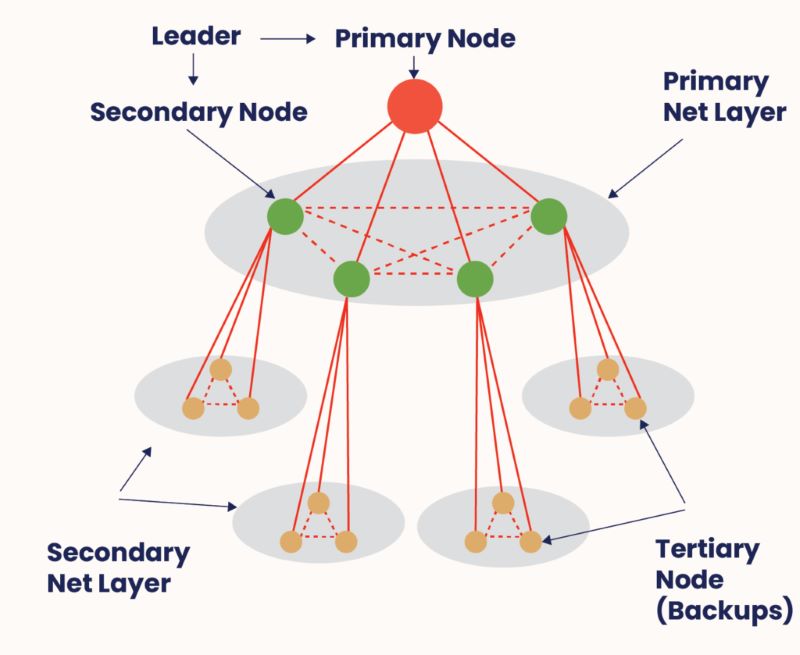

While DAG enables rapid transaction validation, Lachesis serves as the security backbone for the numerous chains within the Fantom ecosystem.

But what exactly is Lachesis?

In the realm of blockchain, a consensus mechanism is essential for validating transactions and ensuring the security of the distributed database. Fantom employs the Lachesis Protocol, which utilizes an Asynchronous Byzantine Fault Tolerant (aBFT) algorithm to achieve exceptional data storage performance.

Lachesis Protocol Example

Let’s imagine a company’s marketing department with four leaders, each leading a team. Their shared goal is to create a successful campaign. To achieve this, they send team members to a rival company to gather insights. However, this decentralized approach poses risks: team members could be lured away with higher salaries, and leaders might change their strategies, potentially jeopardizing the entire campaign.

This scenario mirrors a decentralized network or blockchain, where each leader represents a node. While decentralization offers independence, it can also lead to rule violations. So, how can a stable network and fair consensus be maintained?

The answer lies in the Byzantine Fault Tolerance (BFT) algorithm. This ensures a transparent, trustless network even in the presence of malicious actors. Nodes agree on transaction timing and block creation, and the network can reach a fair consensus even if one-third of the nodes become faulty or act maliciously.

Fantom’s Lachesis aBFT takes this further by removing time constraints on delayed messages, allowing for even greater flexibility and resilience.

In conclusion, understanding Fantom’s functionality hinges on recognizing its utilization of the Lachesis aBFT consensus protocol across multiple layers. This enables near-instant transaction confirmations, making it a highly scalable and secure protocol for the Fantom network.

What is Fantom Opera?

Fantom Opera is the mainnet of the Fantom network, serving as a fully permissionless and open-source environment for building decentralized applications (dApps). It leverages the speed and fast finality of Fantom’s aBFT consensus algorithm, ensuring that transactions are confirmed and irreversible within one to two seconds.

In contrast, older blockchains like Bitcoin and Ethereum rely on probabilistic finality mechanisms, resulting in longer transaction confirmation times. For example, Bitcoin’s average finality time is around 60 minutes, while Ethereum’s is around 6 minutes. Opera’s significantly faster finality addresses this issue, enhancing the network’s efficiency and user experience.

Is Fantom an ethereum killer?

Fantom’s impressive features and rapid transaction speeds have led to speculation: could it potentially overtake Ethereum?

Two key factors contribute to this possibility. Firstly, Fantom boasts superior speed and transaction capacity compared to Ethereum, with significantly lower fees. This suggests a higher potential for widespread adoption compared to Ethereum, which is notorious for its high gas fees and congestion.

Secondly, Fantom’s compatibility with the Ethereum Virtual Machine (EVM) simplifies the migration of projects from Ethereum to Fantom, further boosting its appeal.

If this trend continues in Fantom’s favor without a counter-response from Ethereum, the latter could face a challenging situation.

What is The Fantom Coin used for?

Securing the Network: FTM plays a vital role in maintaining the security and integrity of the Fantom network. This is primarily achieved through staking, where users lock up their FTM tokens to participate in the validation process, ensuring the accuracy and validity of transactions.

On-Chain Governance: FTM holders have a say in the future direction and development of the Fantom network. They can participate in on-chain governance by voting on proposals and making decisions about the network’s upgrades and improvements.

Network Fees: FTM is used to pay for transaction fees on the Fantom network. This ensures that the network can sustain itself and continue to operate efficiently, while also incentivizing users to optimize their transaction sizes and frequency.

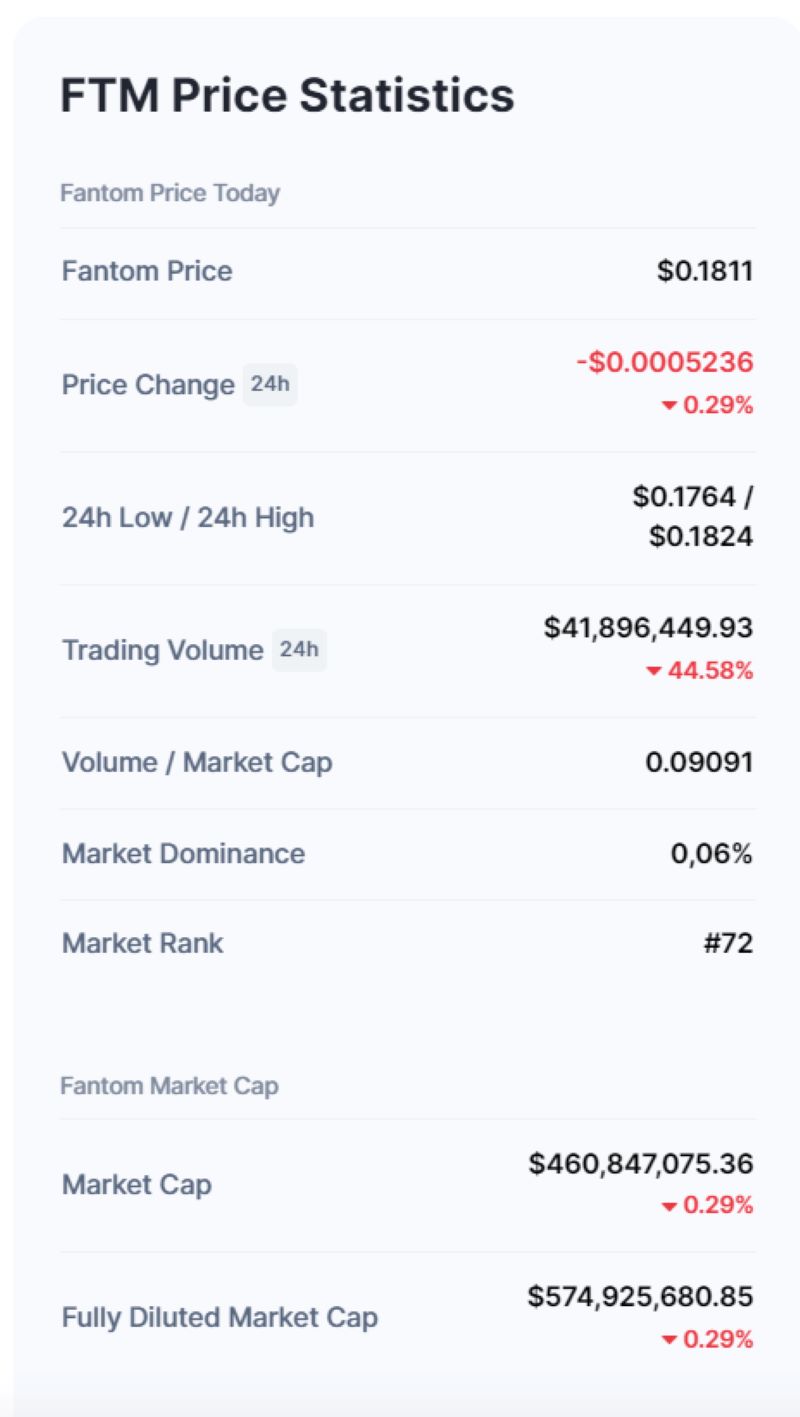

Fantom price history

Since its December 2019 launch, the Fantom token has experienced a dramatic price increase of over 19,500%. However, its value has been subject to the volatility common in the cryptocurrency market.

After reaching a peak of almost $3.41 in early January 2022, FTM entered a period of decline. This downward trend led to a low of $1.07 by mid-March, followed by a further halving of its value to around $0.40 by early summer 2022, where it has remained relatively stable.

The chart illustrating FTM’s yearly price performance as of November 2022 provides a visual representation of this volatility, highlighting both its meteoric rise and subsequent fluctuations.

As of the end-2022, it has a circulating supply of 2,545,006,273 FTM coins and a max. supply of 3,175 000,000 FTM coins.

Our Fantom Price Prediction article will help you better understand what to expect from this cryptocurrency in the coming years.

How can i buy Fantom (FTM)?

Buying Fantom (FTM) is accessible on major centralized exchanges. If you already have an account on one, simply place a buy order. If not, follow these steps:

Set up a crypto account: Choose an exchange that lists FTM and create an account. You can fund your account via wire transfer or credit/debit card (check for any bank restrictions). Fees may apply.

Connect a crypto wallet: Just like a physical wallet for cash, you need a digital wallet to store your FTM. Set up a compatible wallet – we’ve compiled a comparison of the best FTM wallets for your convenience. Note that some exchanges offer custodial wallets, which might restrict you from moving your crypto off the platform.

Trade FTM: Once your account is funded and your wallet connected, place a buy order to start trading FTM!

How to Sell Fantom (FTM)?

Once you’ve decided to sell your FTM, the next step is determining whether you want to exchange it for a traditional fiat currency like U.S. dollars (USD) or another cryptocurrency.

Prepare for the Trade

Select your trading pair, such as FTM/ETH. Trading FTM for USD may involve different steps than exchanging it for another cryptocurrency, so be aware of the specific requirements for your chosen pair.

Identify the Best Price

Cryptocurrency prices fluctuate constantly, so research beforehand to recognize a favorable deal when it arises. Stay updated on market trends and price movements to maximize your potential gains.

Execute the Trade

Once you’ve identified a suitable price and chosen your trading pair, proceed with buying or selling your FTM. If you intend to stop trading on the exchange, ensure you transfer your cryptocurrency or cash to your wallet to secure your assets.

Consider Tax Implications

Cryptocurrency gains are subject to taxes, so be aware of the tax consequences associated with selling your FTM. If needed, consult a tax professional to ensure compliance with relevant regulations.

What is building on Fantom?

SpookySwap (BOO): An automated market maker (AMM) on the Fantom Opera network, facilitating decentralized exchange of tokens.

Multichain: A cross-chain router protocol that enables seamless transfer of assets between different blockchain networks.

Scream (SCREAM): A lending protocol and the second most popular project on Fantom in terms of total value locked (TVL), allowing users to lend and borrow assets.

Beethoven X: An automated portfolio manager and price sensor that facilitates decentralized exchange of Fantom tokens.

Geist Finance: A decentralized lending protocol similar to Aave, but built on the Fantom network.

Protofi (PROTO): A unique AMM that allows investors to become partial owners of the protocol and earn dividends.

What is so unique about Fantom?

Fantom’s uniqueness stems largely from its “leaderless” consensus system called Lachesis. This asynchronous Byzantine Fault Tolerant (aBFT) consensus protocol ensures network security and accelerates transactions, a significant advancement in blockchain technology.

Lachesis allows for asynchronous data processing, accommodating nodes located in different time zones and geographical locations. This flexibility is crucial for a global network, enabling efficient communication and coordination regardless of participants’ physical locations.

Another distinguishing factor is Fantom’s near-instant transaction finality. Unlike Bitcoin and Ethereum, which have significantly longer confirmation times, Fantom finalizes transactions within seconds, thanks to its innovative Lachesis consensus mechanism.

Furthermore, Fantom’s Opera mainnet stands out due to its self-contained nature. This means that each decentralized application operates on its own blockchain, ensuring that traffic congestion or issues on one chain do not impact the others. This modular architecture enhances the network’s overall resilience and performance.

In summary, Fantom’s uniqueness lies in its innovative Lachesis consensus mechanism, asynchronous data processing, rapid transaction finality, and self-contained Opera mainnet. These features collectively contribute to a highly scalable, secure, and efficient blockchain platform that sets Fantom apart from its competitors.

Ready to explore the potential of Fantom for your blockchain projects? Visit Solution of Blockchain for expert guidance, cutting-edge solutions, and the latest insights on Fantom and other leading blockchain technologies.