Bitcoin, the world’s leading cryptocurrency, has created significant waves in the global financial market. One of the most frequently asked questions by investors is what is bitcoin’s all-time high? What is the highest price Bitcoin has ever reached? Let’s explore the historical milestones and factors influencing the value of this digital currency.

What is Bitcoin’s All-Time High?

A Look Back at Bitcoin’s Record-Breaking Price Points

The story of Bitcoin’s all-time high is a tale of innovation, volatility, and the ever-evolving landscape of the cryptocurrency market. To truly understand its significance, we must delve into the genesis of Bitcoin and trace its journey to its record-breaking price points.

The Genesis of Bitcoin and Its Initial Value

Bitcoin emerged in 2008 as the brainchild of an anonymous individual or group known as Satoshi Nakamoto. Its initial value was negligible, existing primarily as a theoretical concept. However, the idea of a decentralized digital currency, resistant to government control and inflation, resonated with early adopters.

Factors Contributing to Bitcoin’s Early Growth

In the early days, Bitcoin’s growth was fueled by many factors, including its limited supply capped at 21 million coins, its inherent scarcity, and the growing awareness of its potential for disrupting traditional financial systems. The first exchange for Bitcoin, established in 2010, facilitated trading and spurred further adoption.

Identifying Bitcoin’s First Major Price Peak

Bitcoin’s initial rise in value was gradual, but it began to gain significant momentum in 2013. This early price surge was primarily attributed to increased media attention, growing interest in cryptocurrency, and the emergence of new exchanges and Bitcoin-related businesses.

When Did Bitcoin Reach its Peak Price?

Pinpointing the Date and Time of Bitcoin’s Highest Value

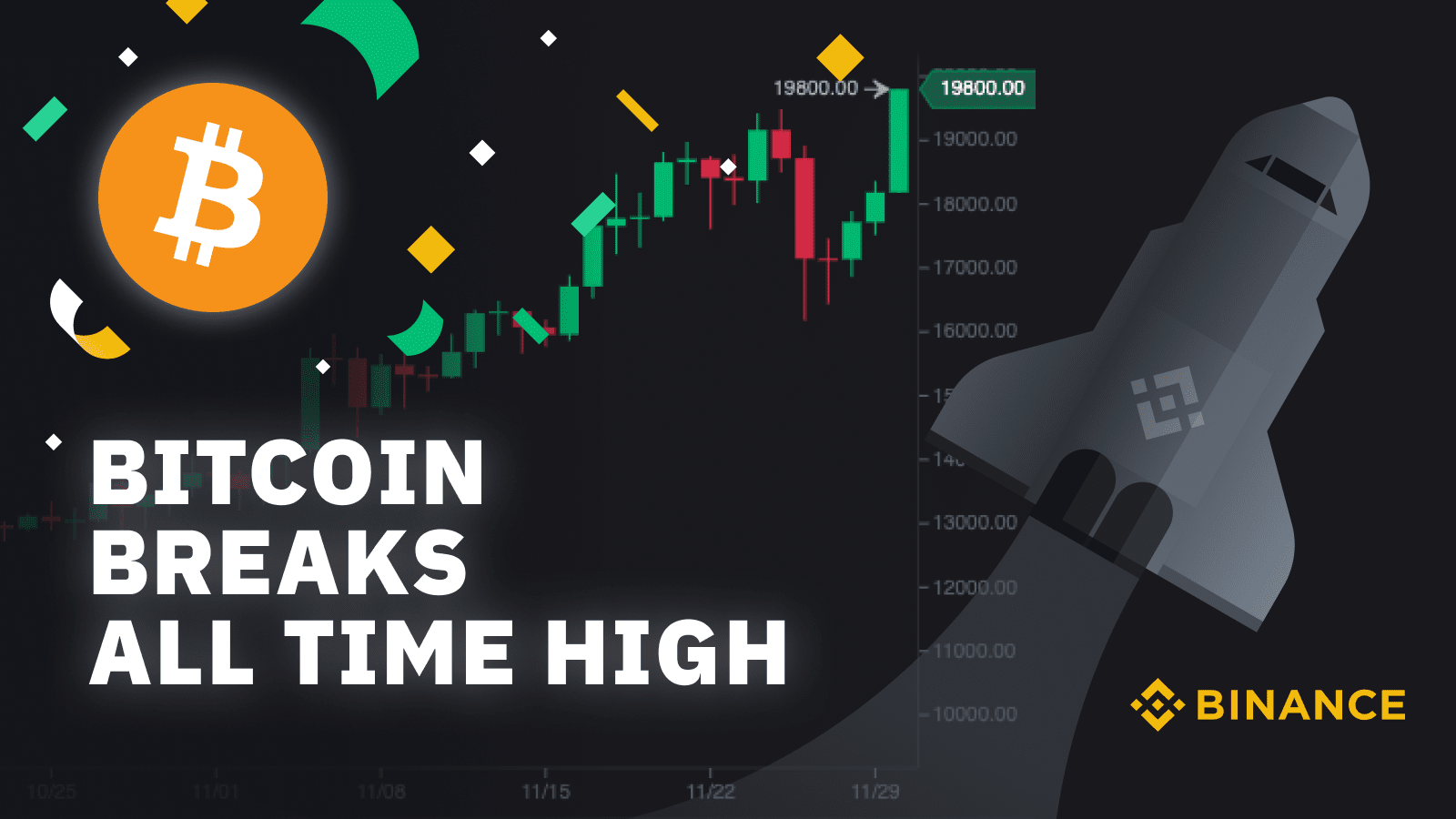

Determining Bitcoin’s all-time high requires careful examination of historical price charts and data. While the specific date and time can vary slightly depending on the data source, Bitcoin reached its highest price point on December 17, 2017, reaching a peak of nearly $20,000 per Bitcoin.

Examining Historical Price Charts and Data

Cryptocurrency exchanges and data aggregators like CoinMarketCap provide comprehensive price charts that track Bitcoin’s historical performance. These charts showcase the dramatic fluctuations Bitcoin experienced in the years leading up to its all-time high, culminating in a momentous surge that captured global attention.

The Significance of This Moment in Bitcoin’s History

Bitcoin’s all-time high in 2017 marked a pivotal moment in the evolution of cryptocurrencies. It brought unprecedented mainstream recognition, fueling a frenzy of investment and sparking a wave of new crypto projects. The surge also highlighted the immense volatility of the cryptocurrency market and fueled debate among investors, economists, and policymakers.

Market Sentiment and Events Surrounding the All-Time High

The events leading up to Bitcoin’s all-time high were characterized by a surge in investor optimism and a growing belief in cryptocurrencies’ potential. The emergence of Bitcoin futures trading platforms, the increasing number of institutional investors entering the market, and the widespread adoption of Bitcoin as a payment method all contributed to the bullish sentiment.

Could Bitcoin Reach New Highs?

Analyzing the Potential for Bitcoin to Surpass its Previous Record

While Bitcoin’s future price is inherently unpredictable, several factors could potentially drive its value higher than its previous record.

Factors That Could Drive Future Bitcoin Price Growth

Increased institutional adoption, regulatory clarity, and the development of new use cases for Bitcoin are all potential drivers for future price growth. The increasing integration of Bitcoin into existing financial systems and the development of new decentralized applications (dApps) built on the blockchain could further fuel its adoption and drive its value higher.

Expert Opinions and Market Predictions

Experts and analysts hold diverse opinions on Bitcoin’s future price trajectory. Some remain optimistic about its potential for long-term growth, citing its limited supply, growing adoption, and inherent value as a digital store of wealth. Others are more cautious, highlighting the volatility of the cryptocurrency market and the significant challenges Bitcoin faces in achieving widespread adoption.

Understanding the Volatility and Risk Associated with Bitcoin

It is crucial to recognize that Bitcoin is a highly volatile asset. Its price can fluctuate significantly within short periods, presenting opportunities and risks for investors. Understanding the risk factors associated with Bitcoin is essential for making informed investment decisions.

Investing in Bitcoin Today

Navigating the Current Crypto Landscape and Making Informed Decisions

Cryptocurrencies are constantly evolving, with new technologies and trends emerging regularly. Understanding the changing landscape and making informed decisions about investing in Bitcoin requires careful consideration.

Strategies for Buying, Selling, and Holding Bitcoin

There are multiple strategies for participating in the Bitcoin market. Some investors frequently opt for active trading, buying and selling Bitcoin to capitalize on short-term price fluctuations. Others prefer a buy-and-hold approach, aiming to benefit from Bitcoin’s long-term growth potential.

Choosing the Right Crypto Exchange or Platform

Many crypto exchanges and platforms exist, each with fees, security measures, and trading features. Choosing the right platform for your needs requires due diligence and careful consideration of security, fees, availability of trading pairs, and customer support.

Managing Risk and Protecting Your Investment

Investing in Bitcoin involves risk, and it is crucial to manage those risks effectively. Diversifying your portfolio, investing only what you can afford to lose, and staying informed about market developments can help mitigate those risks.

It is essential to remember that past performance is not indicative of future results, and the cryptocurrency market is inherently unpredictable. Bitcoin investment should be approached with prudence and a thorough understanding of the potential risks and rewards involved.

So, we’ve delved into Bitcoin’s all-time high. Bitcoin continues to be a compelling digital asset through the ups and downs. To dive deeper into blockchain technology, Bitcoin’s backbone, and uncover fresh investment prospects, check out Solution of Blockchain.