Bitcoin Halving: What date is the Bitcoin halving

Bitcoin halving is a pivotal event in the cryptocurrency world, significantly impacting the supply and price of Bitcoin. As the next halving approaches, investors and enthusiasts alike are eager to know the date and implications of this event. In this article, we’ll delve into what date is the bitcoin halving, its historical significance, and, most importantly, the date of the upcoming halving.

What is Bitcoin Halving and Why Should You Care?

Bitcoin’s halving is a crucial event in the cryptocurrency world, occurring every four years, and it significantly impacts the cryptocurrency’s value and future trajectory. This event is designed to create scarcity, a key factor in the value proposition of Bitcoin, which mimics the scarce nature of precious metals like gold.

Bitcoin’s core principle is limited supply. The halving event is the mechanism that forces this scarcity. The halving reduces the rate at which new Bitcoin is created, making the existing coins more valuable. The halving event acts as a built-in deflationary pressure on the supply, theoretically leading to an increase in price.

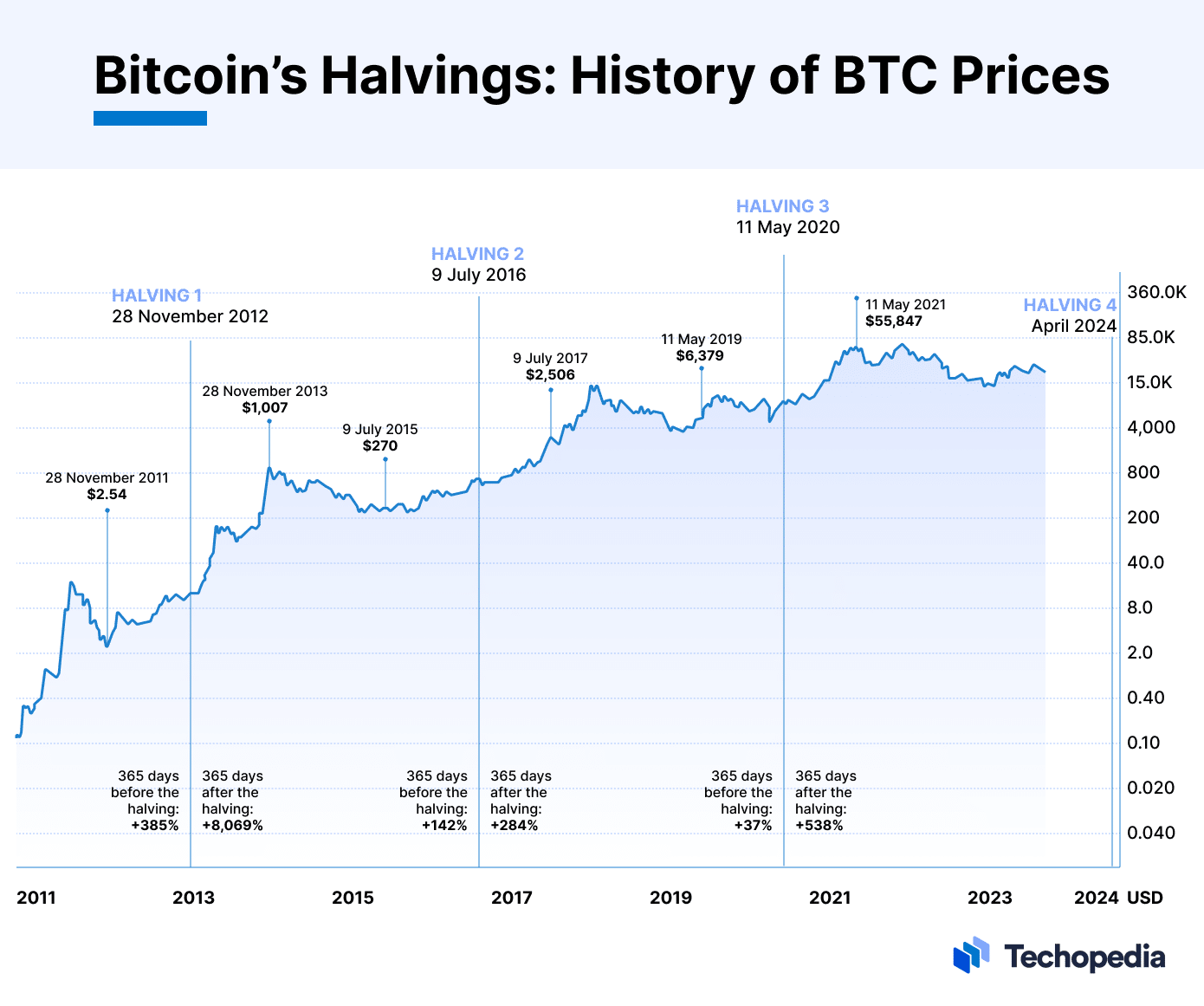

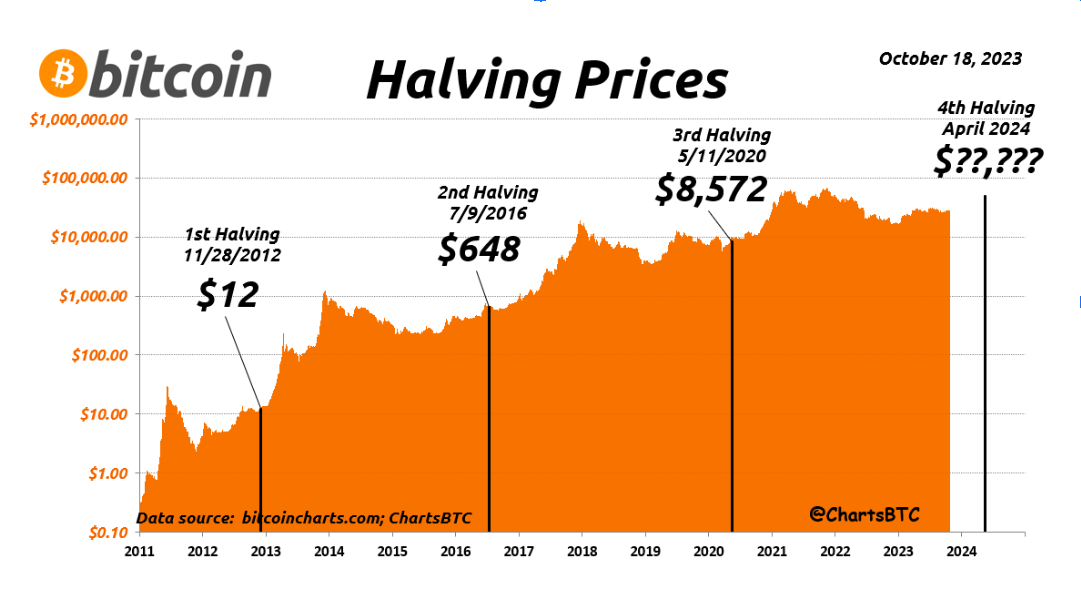

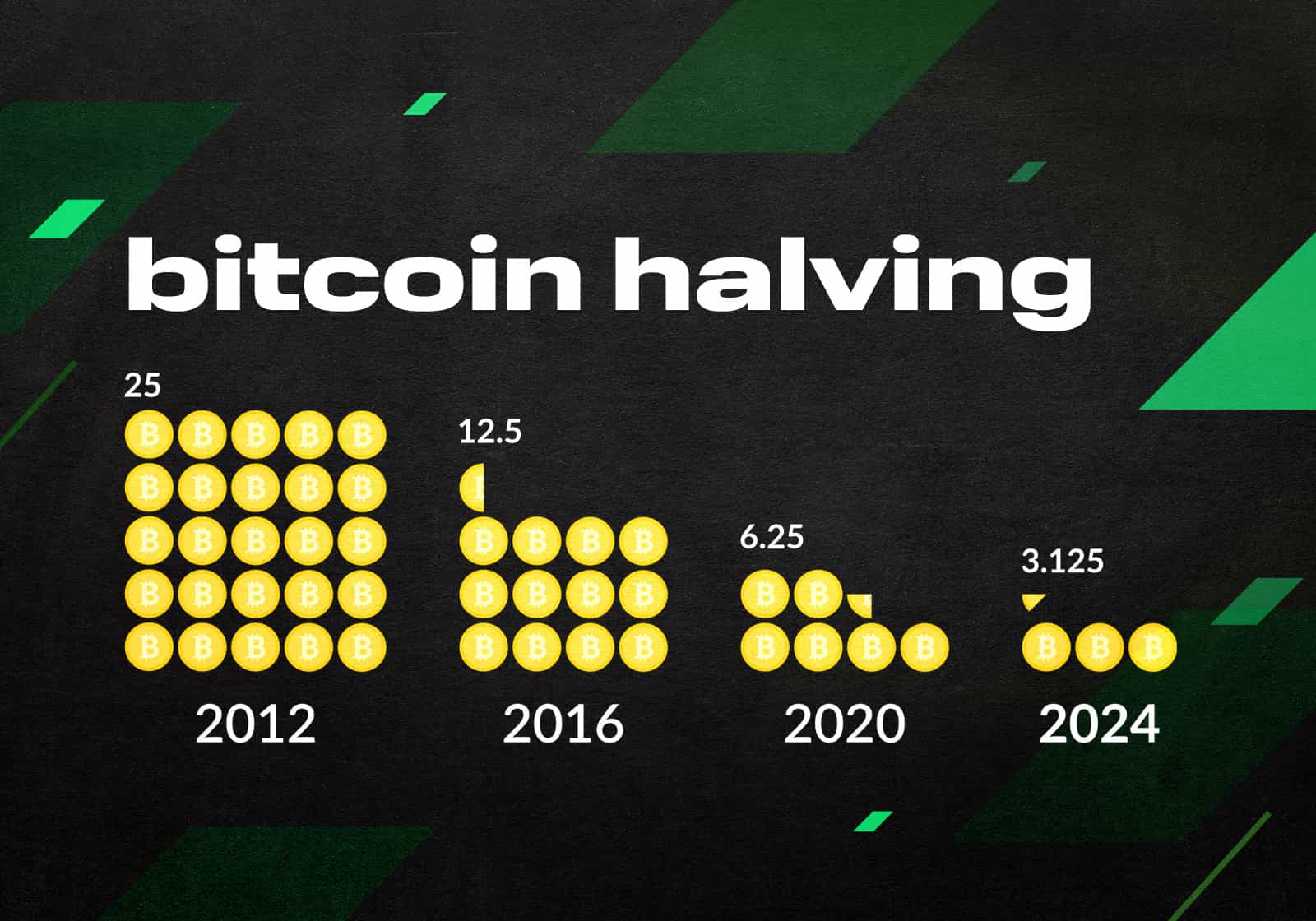

History shows that Bitcoin has experienced a significant price surge after each halving event. The first halving in 2012 saw a price increase from approximately $12 to $1,000. The second halving in 2016 witnessed an even more dramatic rise from under $500 to nearly $20,000.

While past performance is not an indicator of future results, these historical data points suggest that the halving events have significantly impacted Bitcoin’s price trajectory.

When Will the Next Bitcoin Halving Occur?

Calculating the Halving Date

The halving occurs every 210,000 blocks, roughly every four years. The exact date of the halving is dependent on the rate at which blocks are mined.

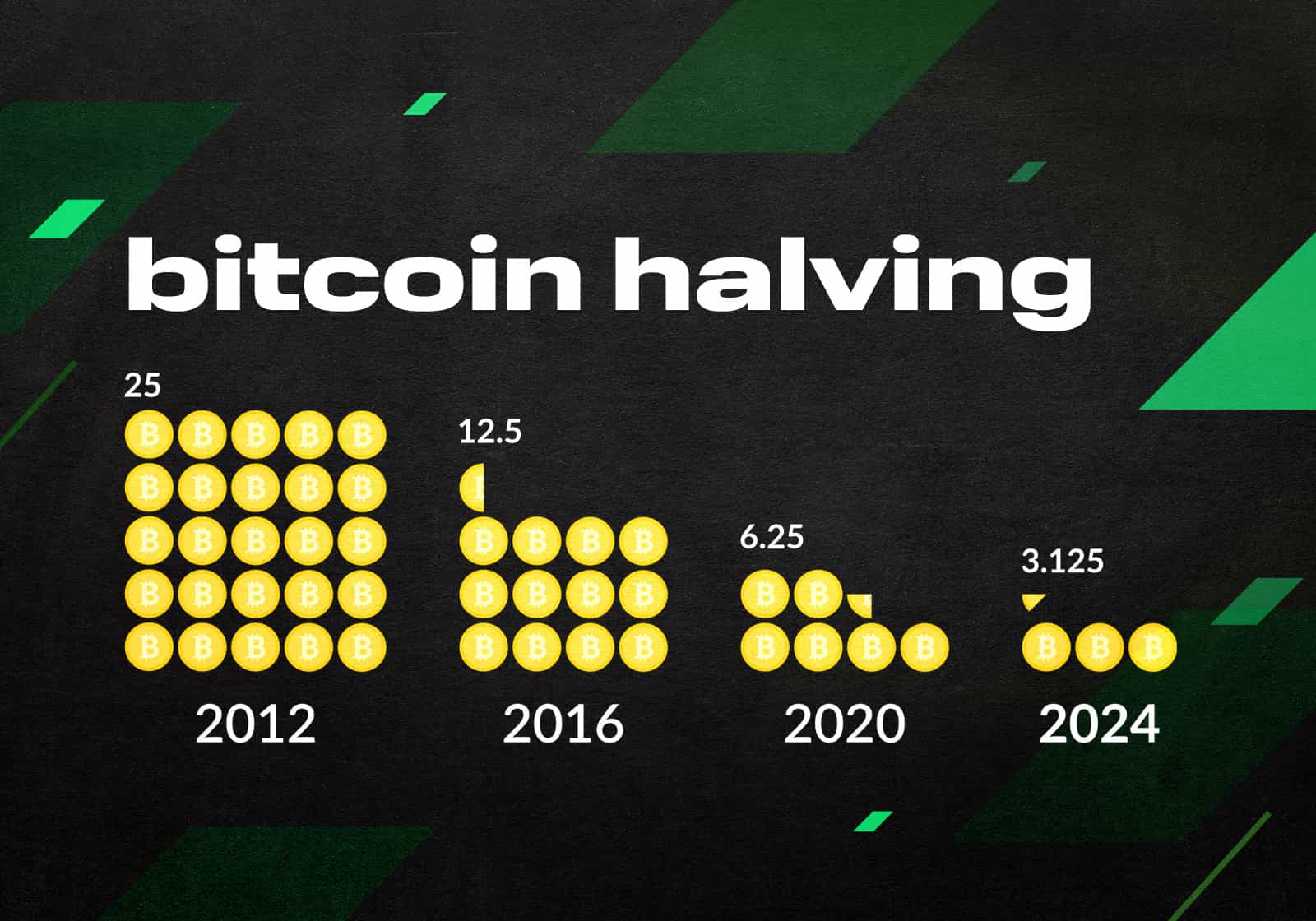

Currently, miners receive 6.25 Bitcoin as a reward for successfully verifying a block. After the next halving, this reward will be cut in half to 3.125 Bitcoin. This gradual decrease in the block reward ensures that the total number of Bitcoins ever created will remain capped at 21 million.

Several factors can influence the exact date and time of the halving. These include:

- The Difficulty of Mining: Fluctuations in the difficulty of mining can affect the time it takes to mine a block, impacting the halving date.

- Hash Rate: The overall computational power of the Bitcoin network, known as the hash rate, can also influence block mining times.

Potential Implications of the Upcoming Halving

Price Volatility and Market Sentiment

The halving event typically leads to increased price volatility as market participants speculate on the future price trajectory of Bitcoin.

Bullish Scenarios:

- Increased scarcity and limited supply could lead to price appreciation as investors seek to capitalize on the perceived value increase.

- Anticipation and hype around the halving could drive demand and push prices higher.

Bearish Scenarios:

- The market could be negatively affected if the halving event fails to meet the expected demand.

- Overly optimistic expectations could lead to disillusionment and a price correction.

Impact on Miners and Network Security

The halving event directly affects Bitcoin miners, as it reduces their revenue.

- Miners may experience a decrease in profitability due to the reduced block reward. This could lead to some miners exiting the market, potentially impacting the network’s hash rate.

- However, the halving event can also incentivize miners to become more efficient, potentially increasing the hash rate as they seek to maximize their rewards.

Preparing for the Halving Event

Strategies for Crypto Investors

While predictions are difficult, investors can adopt strategies to mitigate risk and potentially capitalize on the potential price movements.

- Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This strategy helps to mitigate risk by averaging the purchase price.

- Diversifying one’s portfolio by investing in other cryptocurrencies helps to reduce reliance on Bitcoin and protect against potential downside risks.

- It’s essential to understand and manage risk by conducting thorough research, setting realistic investment goals, and avoiding impulsive decisions driven by fear of missing out (FOMO).

- Remember that the cryptocurrency market is inherently volatile, and there are inherent risks associated with investing.

While the halving event is a short-term catalyst for price fluctuations, the long-term outlook for Bitcoin remains positive for several reasons.

- Increasing institutional adoption and mainstream acceptance of Bitcoin as a store of value and a hedge against inflation could drive continued price appreciation.

- The increasing interest from major financial institutions adds credibility and legitimacy to the cryptocurrency market, potentially attracting new investors.

- In an era of rising inflation and economic uncertainty, Bitcoin’s limited supply and decentralized nature make it an attractive proposition as a hedge against inflation.

- As governments and central banks grapple with inflation, investors are likely to seek alternative assets, potentially leading to increased demand for Bitcoin.

The Bitcoin halving is a crucial event with the potential to impact the cryptocurrency’s future trajectory. While the event has historically led to price increases, the outcome remains uncertain. Investors should approach the halving with a balanced perspective, conducting thorough research, and adopting appropriate risk management strategies.

Understanding the timing and impact of Bitcoin halving is crucial for anyone involved in cryptocurrency. With the next halving on the horizon, now is the perfect time to prepare and strategize your investments. For the latest updates and detailed information about what date the Bitcoin halving will occur, visit Solution Of Blockchain. Stay ahead in the crypto game!