What are Stablecoins? Interesting facts you might not know

In the volatile cryptocurrency market, stablecoins have emerged as an effective solution to mitigate risks and bring stability. So, what are stablecoins? Let’s delve into the details in this article.

What are Stablecoins?

Stablecoins are a type of cryptocurrency designed to maintain a stable value by pegging their value to another stable asset, such as fiat currency (USD, EUR), gold, or another cryptocurrency. The main goal of this cryptocurrency is to minimize the price fluctuations commonly seen in other cryptocurrencies like Bitcoin or Ethereum, thereby facilitating trading, payments, and investment activities in the crypto market.

Examples:

- 1 USDC always has a value equivalent to 1 USD.

- 1 USDT always has a value equivalent to 1 USD.

Benefits of Stablecoins

Stablecoins offer numerous benefits to users in the cryptocurrency market, which can be summarized as follows:

- Price Stability: This is the core benefit of stablecoins. By pegging their value to a stable asset like fiat currency or gold, this cryptocurrency help users avoid the price volatility typical of other cryptocurrencies like Bitcoin or Ethereum. This is particularly useful for investors who want to protect their capital from market fluctuations or for those who want to use cryptocurrency for daily payments without worrying about price changes.

- Transparency: Information about the underlying assets, operating mechanisms, and the amount of stablecoins in circulation is often publicly transparent. Users can easily look up and verify this information, thereby increasing trust and confidence when using this cryptocurrency.

- Convenience: This cryptocurrency can be easily used for transactions, payments, and international money transfers. Thanks to their digital nature and 24/7 operation, stablecoins save time and costs compared to traditional payment methods.

- Low Transaction Fees: Compared to traditional payment methods such as international bank transfers, stablecoin transaction fees are often significantly lower. This helps users save costs, especially for large transactions.

- Accessibility: This cryptocurrency provide access to the global financial system for many people, especially those in developing countries or those without bank accounts. Anyone with an internet connection can use stablecoins for transactions, payments, and investments.

- Bridge to DeFi: Stablecoins play a crucial role in the decentralized finance (DeFi) ecosystem, allowing users to participate in lending, borrowing, yield farming, and many other financial applications.

Classification of Stablecoins

Stablecoins are classified based on their price stability mechanism, each with its own advantages and disadvantages. Here are the 3 main types:

Fiat-Collateralized Stablecoins

This is the most common type of stablecoin. They are issued at a 1:1 ratio with fiat currency, such as USD or EUR. This fiat currency is held in bank accounts to guarantee the value of the stablecoin.

- Advantages: Stable, easy to understand, high liquidity.

- Disadvantages: Reliance on trust in the issuer, centralized risk.

Examples:

- Tether (USDT): Currently the most popular stablecoin, pegged to USD at a 1:1 ratio.

- USD Coin (USDC): Issued by Circle and Coinbase, also pegged to USD.

- Binance USD (BUSD): Issued by Binance exchange, regularly audited by independent auditing firms.

Crypto-Collateralized Stablecoins

This type of stablecoin uses other cryptocurrencies as collateral. To ensure value in the event of market volatility, they are often over-collateralized.

- Advantages: Decentralized, transparent, not dependent on fiat currency.

- Disadvantages: Complex mechanism, risk of collateral liquidation during market volatility.

Example:

- DAI (DAI): A decentralized stablecoin issued by MakerDAO, using ETH as collateral.

Algorithmic Stablecoins

Algorithmic stablecoins use algorithms to adjust supply to maintain price stability. They do not require collateral.

- Advantages: Decentralized, independent, high scalability.

- Disadvantages: Complex mechanism, risk of devaluation if the algorithm does not work effectively.

Examples:

- Ampleforth (AMPL): Adjusts supply daily based on price fluctuations.

- TerraUSD (UST): Uses a token burning and minting mechanism to stabilize the price.

The role of Stablecoins in the cryptocurrency market

This cryptocurrency play a vital role in the cryptocurrency market, contributing to the development and widespread application of blockchain technology. Here are the main roles:

Bridge between fiat currency and cryptocurrency

Stablecoins act as a crucial bridge, allowing users to easily convert between fiat currencies (USD, EUR, etc.) and cryptocurrencies. This simplifies access to the crypto market, attracts new users, and increases market liquidity.

Example: You want to buy Bitcoin but don’t want to go through the complex process of traditional exchanges. You can buy USDT (a stablecoin) with VND on an exchange, then use USDT to buy Bitcoin.

Safe haven in a volatile market

The cryptocurrency market is known for its strong price fluctuations. Stablecoins, with their stable value, provide a “safe haven” for investors during periods of high market volatility.

Example: When the market crashes, investors can quickly convert assets to stablecoins to preserve capital and avoid significant losses. Once the market stabilizes, they can use this cryptocurrency to buy back other cryptocurrencies.

Efficient means of transaction and payment

Stablecoins are widely used as an efficient means of transaction and payment in many areas. With fast transaction speeds, low fees, and transparency, this cryptocurrency offer many advantages over traditional payment methods.

Examples:

- E-commerce: Paying with stablecoins for online transactions of goods and services.

- International money transfers: Sending money quickly and cost-effectively to different countries.

- Remittances: Foreign workers can use stablecoins to send money back home to their families.

Applications in DeFi

Stablecoins play a key role in the decentralized finance (DeFi) ecosystem. They are used as collateral, a medium of exchange, and a unit of account in DeFi applications such as lending, borrowing, yield farming, and DEXs.

Examples:

- Lending and borrowing: Users can borrow or lend stablecoins on DeFi platforms to earn interest.

- Providing liquidity: Providing stablecoins to liquidity pools on DEXs to earn transaction fees.

How to buy and use Stablecoins

Buying and using this cryptocurrency is becoming increasingly easy with the development of cryptocurrency exchanges and applications. Here’s a detailed guide on how to buy and use it:

Buy Stablecoins

There are two main ways to buy stablecoins:

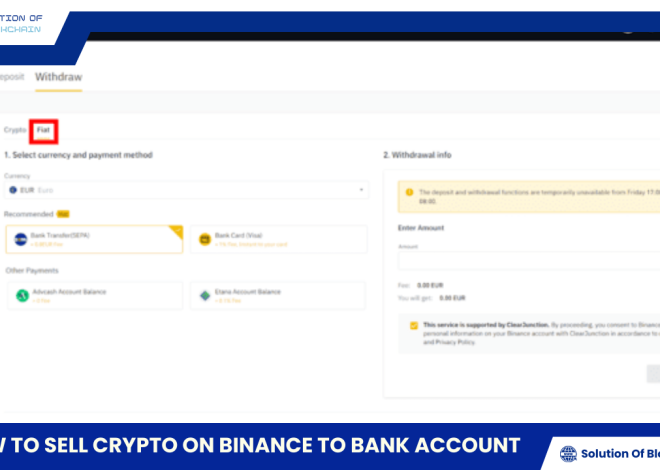

Through Centralized Exchanges (CEX)

Popular CEXs like Binance, Coinbase, Kucoin, Gate.io… allow you to buy stablecoin with fiat currency or other cryptocurrencies.

Steps to buy stablecoins on a CEX:

- Create an account: Register an account on the exchange of your choice.

- Verify your identity (KYC): Complete the identity verification process as required by the exchange.

- Deposit funds: Deposit fiat currency into your exchange account via bank transfer, credit card, or other payment methods.

- Buy stablecoins: Select the type of coin you want to buy (USDT, USDC, BUSD…) and execute the purchase transaction.

Through Decentralized Exchanges (DEX)

DEXs like Uniswap, Pancakeswap, Curve Finance… allow you to exchange stablecoin with other cryptocurrencies.

Steps to buy stablecoins on a DEX:

- Connect your wallet: Connect your cryptocurrency wallet (e.g., Metamask, Trust Wallet) to the DEX.

- Select a trading pair: Choose the stablecoin trading pair you want to buy (e.g., ETH/USDT, BNB/BUSD).

- Execute the trade: Enter the amount of coin you want to buy and confirm the transaction.

Store Stablecoins

After buying stablecoin, you need to store them in a cryptocurrency wallet. There are two main types of wallets:

- Hot wallets: Hot wallets are applications installed on your phone or computer. Examples: Metamask, Trust Wallet.

- Cold wallets: Cold wallets are dedicated hardware devices for storing cryptocurrencies offline. Examples: Ledger, Trezor.

Cold wallets are generally considered more secure than hot wallets because they are not connected to the internet.

Use Stablecoins

You can use this cryptocurrency for a variety of purposes:

- Trading and payments: Buying and selling goods and services online or at stores that accept cryptocurrency payments.

- International money transfers: Sending money quickly and at a lower cost than traditional methods.

- Investment: Participating in investment activities in the cryptocurrency market.

Note

- Before buying and using stablecoin, carefully research the type of stablecoin you choose, its operating mechanism, and potential risks.

- Choose reputable exchanges and wallets to ensure the safety of your assets.

- Stay updated on market information and legal regulations related to cryptocurrencies.

Risks of investing in Stablecoins

Although designed for price stability, investing in this cryptocurrency still carries certain risks that investors should be aware of:

Risk of devaluation

- Loss of confidence in the issuer: Fiat-collateralized stablecoins depend on the credibility and ability of the issuer to maintain reserves. If investors lose confidence in the issuer, the stablecoin may lose value. A prime example is the UST (TerraUSD) event – an algorithmic stablecoin – that collapsed in May 2022, causing a domino effect across the cryptocurrency market.

- Ineffective collateral mechanism: For crypto-collateralized stablecoin, if the value of the collateral drops sharply, the stablecoin may lose value or be liquidated.

- Legal risks: Legal regulations are still unclear in many countries. Changes in regulations can affect the operation and value of this cryptocurrency.

Liquidity risk

- Low trading volume: Some stablecoins have low trading volume, making it difficult to buy or sell large amounts.

- Exchange issues: If the exchange listing the stablecoin experiences problems, investors may have difficulty trading or withdrawing funds.

Cybersecurity risks

- Attacks on storage wallets: Stablecoin storage wallets can be attacked, leading to loss of assets.

- Security vulnerabilities: Platforms and DeFi applications that use stablecoins may have security vulnerabilities, creating opportunities for hackers to attack and steal assets.

Other risks

- Inflation risk: Stablecoin pegged to fiat currency are still affected by inflation. During periods of high inflation, the real value of this cryptocurrency may decrease.

- Market manipulation risk: Due to the concentration of trading volume of some stablecoin on certain exchanges, there is a possibility of price manipulation.

To mitigate the risks, investors should:

- Choose reputable stablecoin: Carefully research the issuer, operating mechanism, and reserve assets of the stablecoin.

- Diversify your portfolio: Don’t concentrate all your capital in stablecoin.

- Use secure storage wallets: Choose reputable wallets and enable two-factor authentication (2FA).

- Stay updated on market information: Follow news and important announcements about stablecoin and the cryptocurrency market.

- Invest only what you can afford to lose: Only invest the amount of money you can afford to lose.

Stablecoins play an important role in the cryptocurrency market, bringing stability, convenience, and efficiency to trading, payment, and investment activities. With the continuous development of blockchain technology and DeFi, this cryptocurrency are expected to continue to play a key role in the future of global finance.

Hopefully, this article from Solution Of Blockchain has helped you better understand “What are stablecoins?”. Continue to learn and research to make informed investment decisions!