How to withdraw Crypto to bank account

The world of cryptocurrency presents a unique challenge when it comes to moving your digital assets into traditional financial systems. While the decentralized nature of crypto offers numerous advantages, bridging the gap to your bank account requires careful consideration and a clear understanding of the process. This guide will walk you through the steps how to withdraw crypto to bank account, ensuring a smooth and secure experience.

Understanding Crypto Withdrawals: A Beginner’s Guide to Moving Funds to Your Bank Account

What are the Different Ways to Withdraw Crypto to a Bank Account?

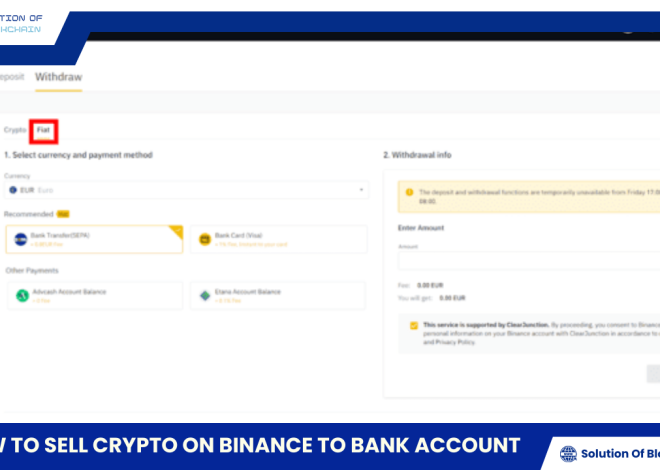

Centralized exchanges act as intermediaries, providing a platform to buy, sell, and trade cryptocurrencies. They often have integrated withdrawal features, allowing you to convert your crypto to fiat currency and transfer it directly to your linked bank account. Examples include prominent exchanges like Binance, Coinbase, and Kraken.

P2P platforms facilitate direct transactions between individuals, bypassing centralized authorities. These platforms often offer escrow services to ensure secure transactions. Users can find buyers willing to purchase their cryptocurrency with bank transfers, providing an alternative withdrawal option. Popular P2P platforms include LocalBitcoins and Paxful.

Crypto debit cards bridge the gap between the crypto world and traditional financial systems. Issued by various cryptocurrency companies, these cards allow you to load cryptocurrency onto them, which is then converted to fiat currency at the point of sale. This allows you to spend your crypto assets at merchants that accept debit cards, effectively withdrawing funds indirectly.

Step-by-Step Guide: How to Withdraw Your Cryptocurrency

Choosing the Right Platform for Your Needs

Prioritize platforms with robust security measures, such as two-factor authentication, cold storage for funds, and a proven track record of protecting user assets. Research their security protocols and user reviews to gauge their reliability.

Compare the fees charged by different platforms for cryptocurrency withdrawals, as they can vary significantly. Additionally, consider the transaction processing times, as some platforms may have faster withdrawal speeds than others.

Ensure the chosen platform operates in your jurisdiction and supports withdrawals to your bank account. Regulatory limitations can impact the availability of services in certain regions.

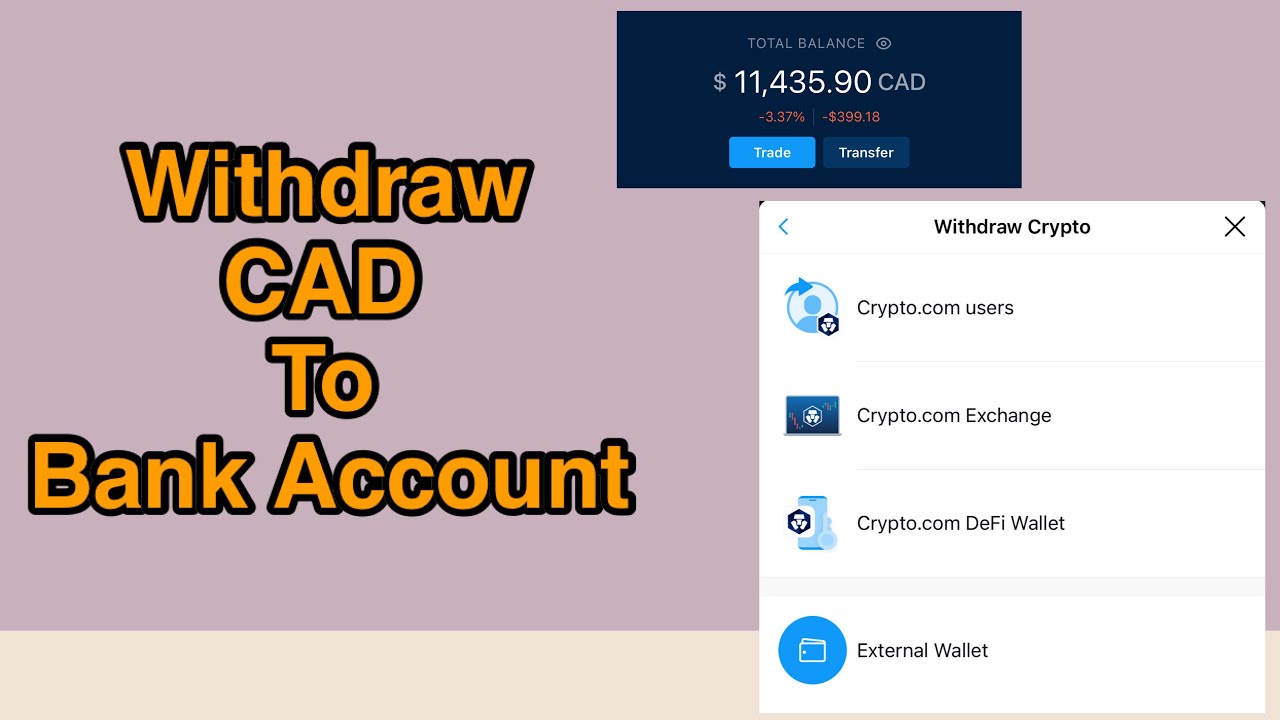

Navigating the Withdrawal Process

Most reputable cryptocurrency platforms adhere to Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. This requires users to verify their identity by providing government-issued identification and proof of address. Be prepared to complete this verification process when withdrawing funds.

To withdraw fiat currency to your bank account, you’ll need to link it to your chosen platform. This typically involves providing your bank account details, such as the account number and routing number.

Enable two-factor authentication (2FA) on all your cryptocurrency accounts to enhance security. This adds an extra layer of protection, requiring a unique code from your mobile device in addition to your password when logging in or initiating transactions.

Initiating and Completing Your Withdrawal

Be aware of the minimum and maximum withdrawal limits set by the platform. These limits can vary depending on the platform and the specific cryptocurrency you are withdrawing.

Once you have initiated the withdrawal, you will receive a transaction ID. Use this ID to track the progress of your withdrawal on the blockchain or through the platform’s transaction history.

In case of any issues or delays, contact the customer support of the platform you used for assistance. They can help resolve any technical difficulties or address concerns related to your withdrawal.

Important Factors to Consider When Withdrawing Cryptocurrency

Security Measures to Protect Your Assets

Be wary of phishing scams and fraudulent websites impersonating legitimate cryptocurrency platforms. Double-check URLs, look for secure connections (HTTPS), and avoid sharing your private keys or sensitive information online.

Your private keys are the ultimate proof of ownership for your crypto assets. Store them securely offline, using hardware wallets or offline storage methods, to prevent unauthorized access.

When accessing your cryptocurrency accounts or initiating transactions, use a secure and private internet connection. Avoid public Wi-Fi networks, as they can be vulnerable to hacking attempts.

Tax Implications of Withdrawing Crypto

Understand the tax regulations surrounding cryptocurrency in your country of residence. Tax laws vary widely, and failure to report cryptocurrency transactions accurately can result in penalties.

Consult with a qualified tax advisor to explore potential tax optimization strategies related to your cryptocurrency withdrawals. Holding periods, tax-loss harvesting, and other factors can influence your tax liability.

Future Trends in Crypto Withdrawals

Stablecoins, pegged to the value of fiat currencies, offer price stability and are gaining popularity for transactions. Decentralized Finance (DeFi) platforms are also emerging, potentially providing alternative avenues for crypto withdrawals in the future.

Regulatory landscapes surrounding cryptocurrency are constantly evolving. Stay informed about any new regulations or guidelines issued by relevant authorities, as they can impact the process of withdrawing cryptocurrency.

Tips for a Smooth and Secure Crypto Withdrawal Experience

Best Practices for Beginners

If you’re new to withdrawing cryptocurrency, initiate a small test transaction to familiarize yourself with the process and ensure everything is working correctly before transferring larger amounts.

Always double-check the recipient’s wallet address before confirming any transaction. Cryptocurrency transactions are irreversible, so any error in the address can result in the permanent loss of funds.

Maintain detailed records of all your cryptocurrency transactions, including withdrawal confirmations, transaction IDs, and dates. These records will be essential for tax purposes and resolving any potential disputes.

Maximizing the Value of Your Crypto

Cryptocurrency prices are known for their volatility. Consider market factors and price trends when deciding the best time to withdraw your crypto to maximize your returns.

Beyond withdrawing to your bank account, explore alternative uses for your cryptocurrency, such as making online purchases, investing in other crypto assets, or participating in decentralized finance (DeFi) protocols.

Withdrawing cryptocurrency to a bank account is an important process that requires you to be extremely careful. Always protect your personal information and account to avoid the risk of being hacked. In addition, you should choose reputable exchanges with operating licenses to ensure the safety of your assets. To learn more about reputable exchanges and how to secure your account, please refer to the articles on Solution of Blockchain.