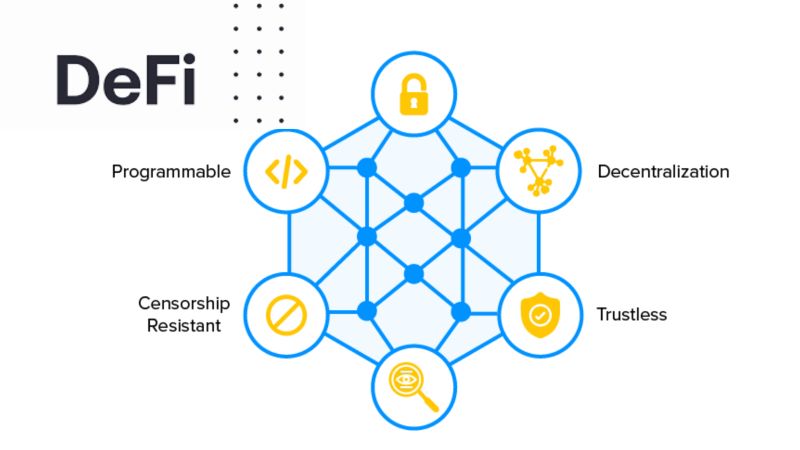

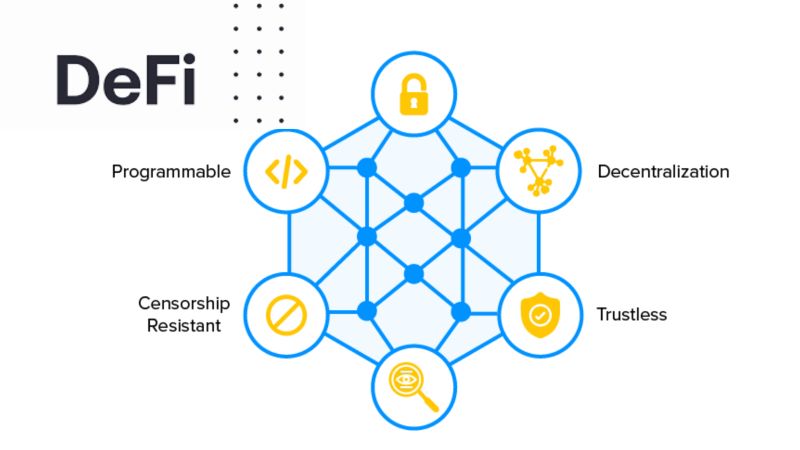

What is DeFi (Decentralized Finance)? How does it work?

Forget banks and brokers. Decentralized Finance is reshaping finance, offering a new world of peer-to-peer transactions on the blockchain. But what exactly is DeFi? And how can it revolutionize your financial future?

What is DeFi (Decentralized Finance)?

Decentralized finance, or DeFi, is a broad term for financial services offered directly on public blockchains, primarily Ethereum. It allows you to perform various financial activities, such as earning interest, borrowing, lending, and trading, without the need for traditional intermediaries like banks. DeFi transactions are faster, require less paperwork, and offer global access to anyone, regardless of their location or financial status.

Why is DeFi important?

DeFi is important because it expands on the concept of digital money, creating a digital alternative to traditional financial systems without the associated overhead costs. This democratization of finance opens up new opportunities for financial inclusion and participation, potentially leading to more open, free, and fair financial markets for all.

What are the benefits of DeFi?

Open: You don’t need to apply for anything or “open” an account. You just get access by creating a wallet.

Pseudonymous: You don’t need to provide your name, email address, or any personal information.

Flexible: You can move your assets anywhere at any time, without asking for permission, waiting for long transfers to finish, and paying expensive fees.

Fast: Interest Rates and rewards often update rapidly (as quickly as every 15 seconds), and can be significantly higher than traditional Wall Street.

Transparent: Everyone involved can see the full set of transactions (private corporations rarely grant that kind of transparency)

What are the downsides?

The decentralized nature of DeFi, while offering numerous benefits, also introduces some downsides:

High transaction fees: Fluctuations in gas fees on the Ethereum blockchain, where most DeFi activity occurs, can make active trading costly.

Volatility: The nascent nature of DeFi technology and the cryptocurrency market itself can lead to significant price swings and investment risks.

Regulatory uncertainty: The regulatory landscape for DeFi is still evolving, and regulations may vary across different regions, creating uncertainty and potential compliance issues.

Record-keeping responsibility: Users are responsible for maintaining their own transaction records for tax purposes, which can be complex and time-consuming.

How does it work?

DeFi operates primarily through decentralized applications (dapps) running on the Ethereum blockchain. Users can access DeFi services directly without the need for traditional account openings or paperwork.

Some common ways people are using DeFi include

Lending: Users can earn interest and rewards by lending out their cryptocurrency, with interest accruing every minute instead of monthly.

Borrowing: DeFi allows for instant loans without paperwork, including “flash loans” that are repaid within the same transaction.

Trading: Peer-to-peer trading of crypto assets is facilitated, bypassing traditional brokerages.

Saving: Users can deposit their crypto into DeFi savings accounts and earn higher interest rates than traditional banks offer.

Derivatives: DeFi platforms enable trading of derivatives, like options or futures contracts, for crypto assets.

In conclusion, decentralized finance (DeFi) is a rapidly evolving landscape that offers exciting opportunities and potential risks. While its ability to revolutionize traditional finance is promising, it’s essential to approach it with caution and awareness of its limitations. The future of DeFi holds immense potential, but its widespread adoption will depend on addressing challenges like high transaction fees, volatility, regulatory uncertainty, and user education.

To navigate the complexities of DeFi and make informed decisions, it’s crucial to stay informed and seek expert guidance. Solutionofblockchain is your trusted partner in exploring the world of decentralized finance. Our comprehensive resources and expert analysis will help you understand the intricacies of DeFi and make the most of its opportunities while mitigating risks.

Don’t miss out on the DeFi revolution. Join Solution of Blockchain today and unlock the potential of decentralized finance.