What is a consensus mechanism? How does it work?

Imagine a global network of computers agreeing on a single version of truth without any central authority. This is the magic of consensus mechanisms, the backbone of blockchain technology that ensures trust, security, and accuracy in a decentralized world.

What is a consensus mechanism?

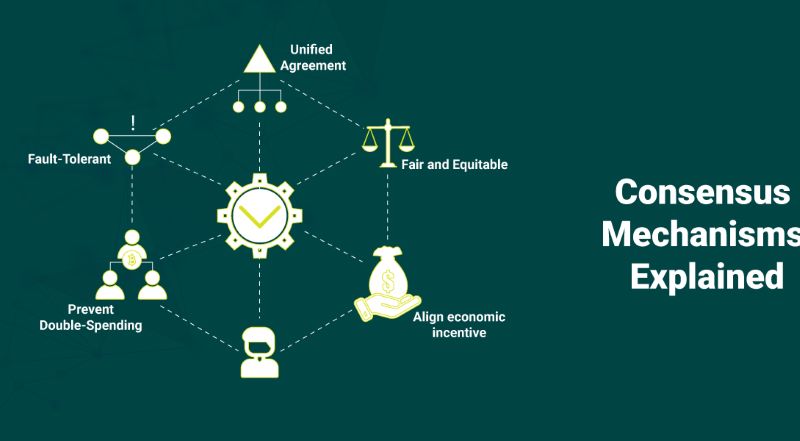

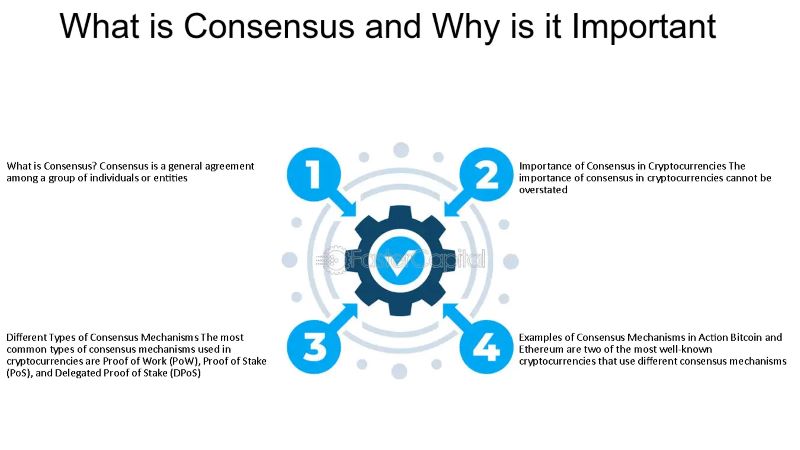

A consensus mechanism is a self-governing set of software protocols embedded within a blockchain’s code. It harmonizes the network, ensuring agreement on the state of the digital ledger. This is achieved by maintaining a single, universally accepted version of the blockchain’s transaction history, rather than each node individually maintaining a complete copy of the database.

Despite the variety of consensus mechanisms available, each approach is designed to detect and prevent fraudulent activity that contradicts the established record.

How does a consensus mechanism work?

Consensus mechanisms in blockchain work by allowing nodes to validate transactions by comparing them to the existing ledger. If a transaction contradicts the established record, it’s rejected by the majority. Nodes that consistently violate consensus rules are often excluded from the network.

In cases where a node disputes the record, a network-wide recall is initiated. The transaction is confirmed and permanently added to the blockchain only if a supermajority of peer nodes approve.

This process mirrors how individuals agree on rules in a game. Like a game of Monopoly, where players collectively determine and abide by the rules, blockchain nodes reach a consensus on transaction validity. This is essential for decentralized finance, where no central authority exists to approve or reject transactions.

Cryptocurrency consensus mechanisms like proof of work (PoW) and proof of stake (PoS) incentivize nodes to participate in validation, either through computational work (PoW) or token ownership (PoS). This ensures the security and integrity of the blockchain, as altering the record requires convincing the majority of participants, much like changing the rules of a game mid-play.

Why are consensus mechanisms important in Blockchain?

Beyond their technical role in maintaining the integrity of distributed networks, consensus mechanisms serve as incentives for responsible behavior. They not only ensure the system’s functionality but also foster trust in a trustless environment.

These mechanisms prevent double-spending, where a digital token is spent more than once, either intentionally or accidentally. In traditional finance, double-spending often results in overdraft fees and requires reconciliation with the bank. However, consensus mechanisms track network activity in real-time, preventing this issue altogether, cultivating trust in the blockchain and enabling its decentralized operation.

Moreover, consensus mechanisms protect against malicious activity. Without them, bad actors could easily corrupt the blockchain. In a proof-of-stake system, for instance, malicious actors would need to control a majority of the validation power and hold a substantial amount of the platform’s coins to successfully validate a fraudulent transaction. This makes it extremely difficult for malicious entities to compromise the blockchain’s integrity.

Types of consensus mechanisms

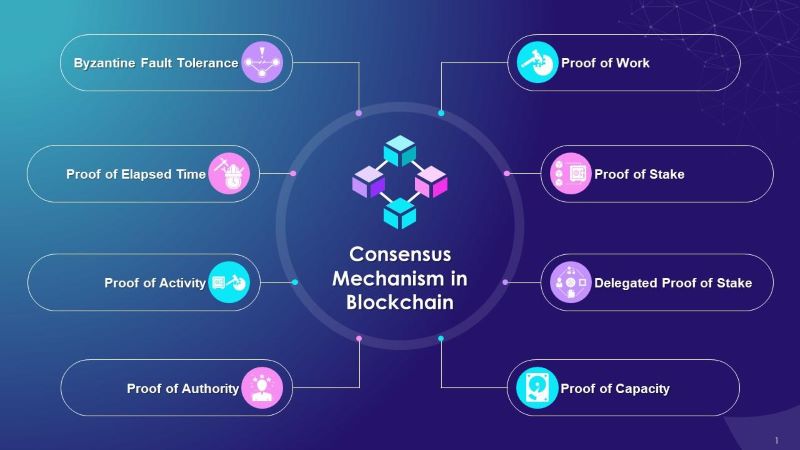

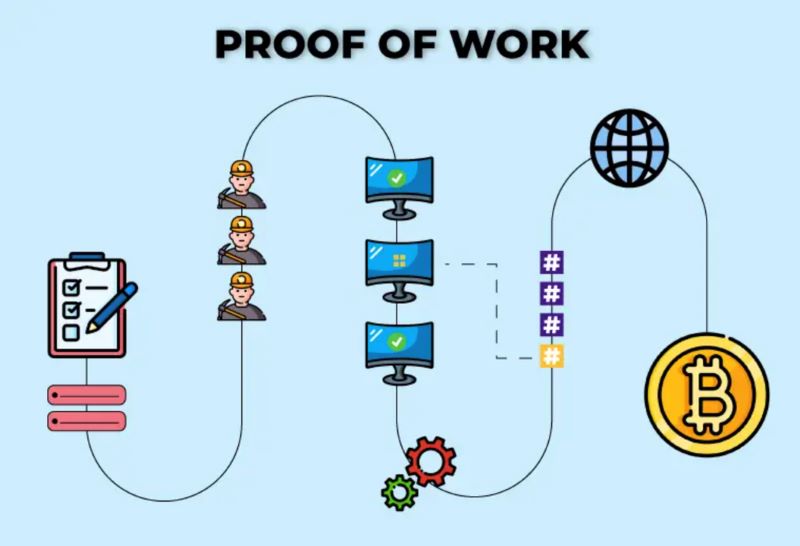

Proof of Work

Proof of Work (PoW) is the original consensus mechanism, relying on miners to validate transactions by solving complex mathematical puzzles for block rewards. This energy-intensive process involves specialized computers competing to find a 64-digit hexadecimal number, or hash, secured by cryptography. Crypto mining, where miners earn newly minted tokens as rewards, is a common application of PoW systems.

Advantages of PoW include its high degree of decentralization and security, resulting in a reliable system. The substantial block rewards, like Bitcoin’s current $16,800, incentivize active participation. However, PoW suffers from slow transaction rates, high gas fees, expensive operations, and significant energy consumption, making it inefficient. Bitcoin’s average transaction time is 10 minutes, and the process demands an immense amount of electricity.

Examples of cryptocurrencies using PoW include Bitcoin, Dogecoin, and Litecoin.

Proof of Stake

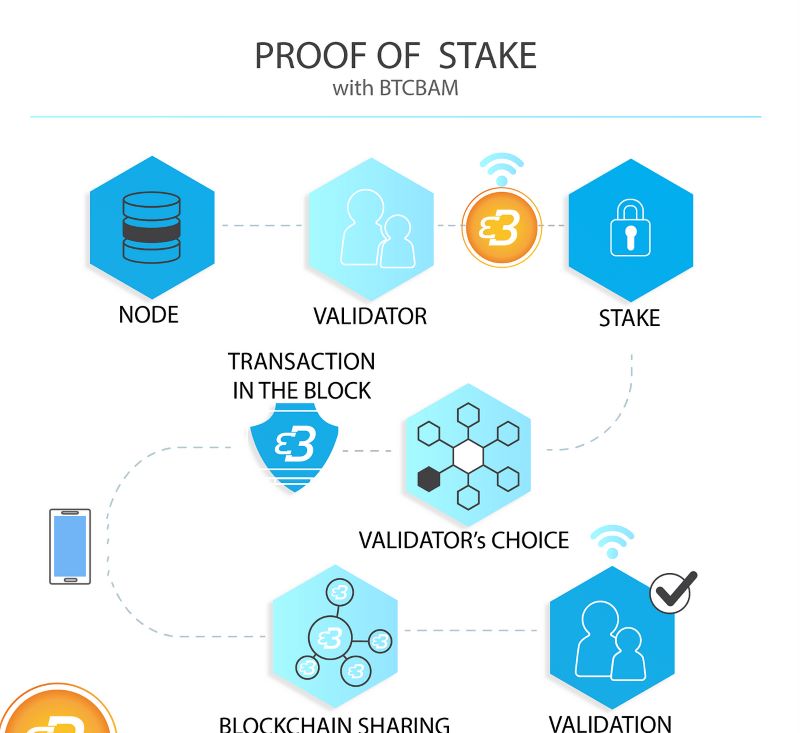

In a proof-of-stake model, users gain validator privileges by “staking” a certain number of tokens, essentially locking them up temporarily. These staked coins earn passive rewards while contributing to the network’s security until the user unstakes them, often for trading purposes. Validator opportunities are randomly assigned to eligible participants through a lottery system, with higher stakes increasing the chances of winning. Besides processing transactions and adding blocks, validators act as data custodians and risk losing their stake if they violate consensus rules.

Proof-of-stake stands out as the optimal consensus method in Web3 for achieving scalability. It’s energy-efficient and cost-effective, with lower gas fees and less reliance on expensive equipment. However, it is not as decentralized or secure as proof of work, as voting power is determined by wallet size, potentially concentrating influence in the hands of larger holders.

Examples of cryptocurrencies using proof of stake include Ethereum, Cardano, Tezos, and Algorand.

Delegated Proof of Stake

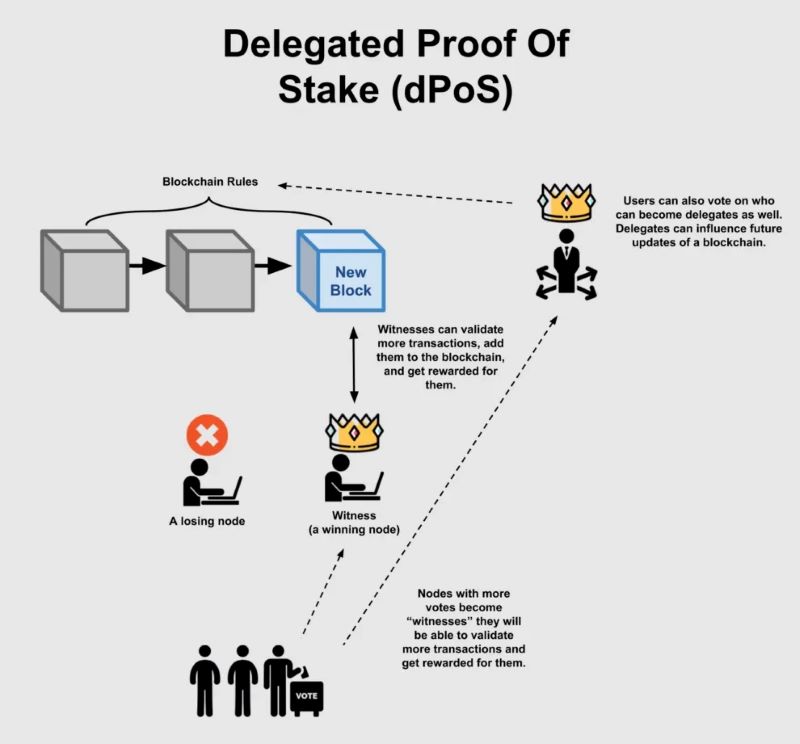

Consider Proof of Stake, but with an election. In this consensus mechanism, network participants use staking pools to vote for preferred delegates, chosen for their reputation as capable network protectors. This limits validating privileges to a select group of trusted candidates, awarded randomly. However, validators can be replaced if a more trustworthy candidate emerges.

The advantage of this system is its efficiency and democratic nature. It improves upon the original PoS by being more inclusive and incentivizing validator accountability. However, the trade-off is reduced decentralization, as network control is concentrated in fewer hands, increasing vulnerability to potential attacks. Additionally, it demands active participation from users, which may be too demanding for some.

Examples of blockchain networks utilizing this approach include EOS, Lisk, Ark, Tron, BitShares, and Steem.

Proof of Authority

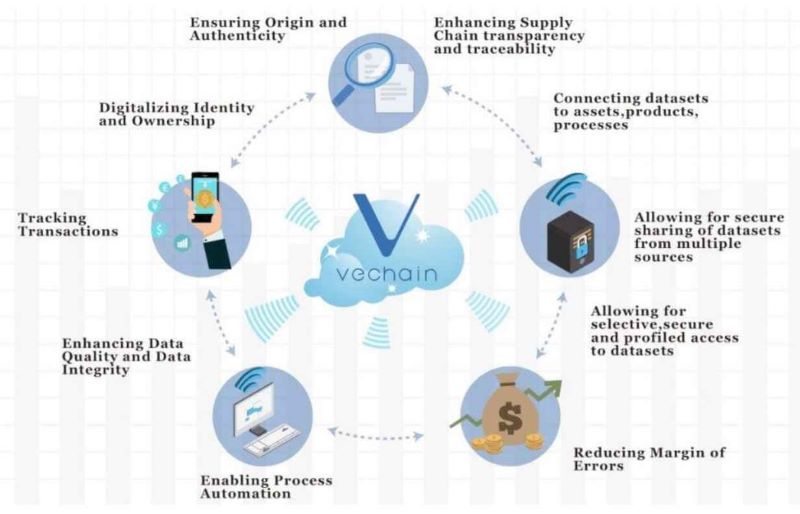

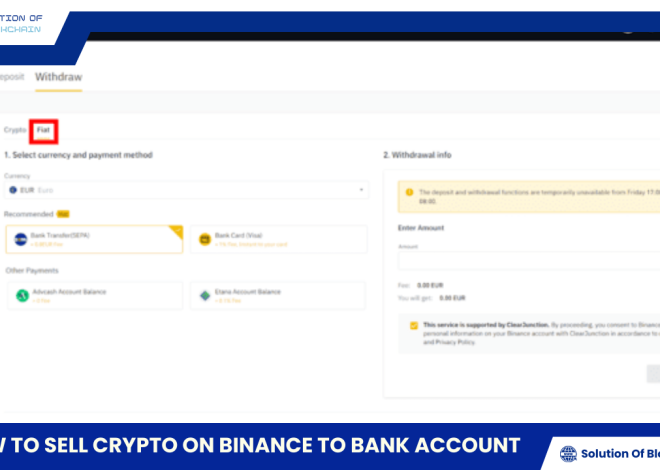

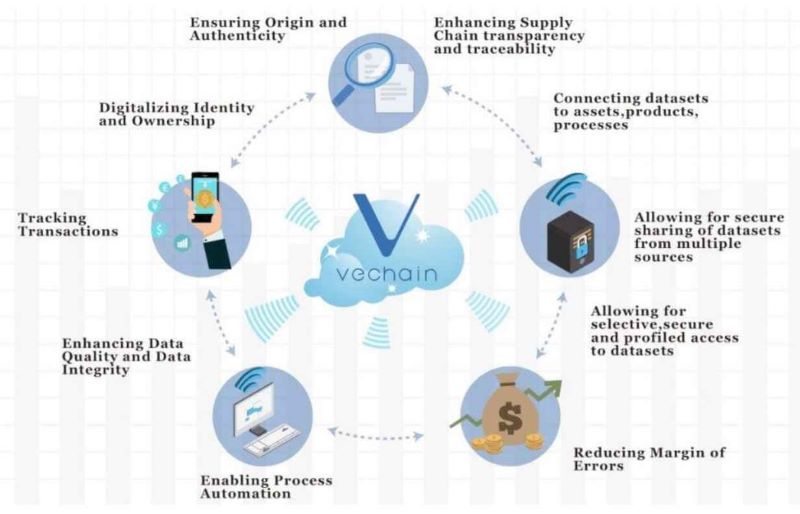

Proof of Authority (PoA) is a consensus mechanism favored by private or permissioned blockchains, where validator selection is based on reputation rather than digital asset holdings. This system involves a vetting process, often including background checks, to pre-approve a group of validators.

The advantage of PoA is its high scalability and minimal computational power requirements. However, this concentration of power compromises decentralization, a core principle of blockchain. Additionally, validators must sacrifice their pseudo-anonymity, as public identification is part of the process.

Examples of PoA implementations include Xodex, JP Morgan’s JPMCoin, VeChain (VET), and the Ethereum Kovan testnet.

Proof of History

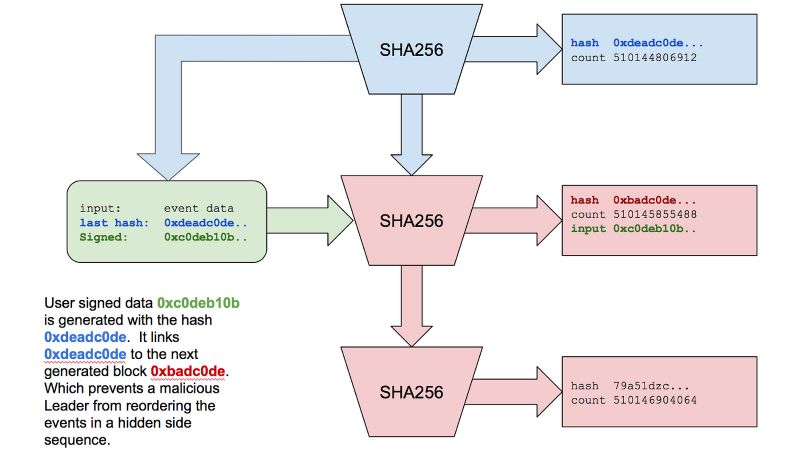

Proof of History incorporates the concept of time directly into the blockchain’s protocol. During verification, timestamps are embedded within the hash of each block, creating a continuous, chronological record of the network’s transactions. It’s worth noting that this method is primarily used as a supplement to other consensus mechanisms, often paired with either proof-of-work or proof-of-stake systems.

One notable advantage of Proof of History is its speed and security without compromising the platform’s decentralization. It is also associated with low transaction fees. Solana, the most prominent example of a blockchain utilizing Proof of History, is renowned for its remarkable speed, boasting block times of merely 400 milliseconds.

However, the trade-off for such high transaction speeds is the accumulation of vast amounts of data. This necessitates specialized hardware capable of handling the processing demands, effectively excluding average users from participating as validators.

Consensus mechanisms are the unsung heroes of blockchain, enabling decentralized networks to function seamlessly and securely. By understanding the different types of consensus mechanisms and their implications, you can unlock the full potential of blockchain technology for your projects.

Ready to explore the world of blockchain consensus and find the perfect solution for your decentralized project? Visit Solution of Blockchain for expert guidance, cutting-edge solutions, and the latest insights on blockchain technology. Let us help you build a secure and scalable future.