What is Bitcoin and how does it work? Investing in Bitcoin

Have you ever heard of Bitcoin, the digital currency taking the world by storm? What is Bitcoin, and how does it work? Let’s dive into the cryptocurrency world and explore the birth, unique mechanisms, and factors that make Bitcoin special.

What is Bitcoin?

Bitcoin, a digital currency that has gained immense popularity recently, is often called a “cryptocurrency” or a “digital gold.” It is a decentralized digital asset, meaning any single entity, such as a government or financial institution, does not control it. Bitcoin operates on a peer-to-peer network, allowing users to send and receive payments directly without intermediaries.

A Simple Explanation of Bitcoin

Imagine a digital ledger that records every Bitcoin transaction, publicly available for anyone. This ledger is known as the “blockchain.” Each block in the blockchain contains a record of multiple transactions, and these blocks are linked together, forming a chain. This chain ensures the integrity and immutability of the recorded data, making it virtually impossible to tamper with or forge transactions.

Key Features of Bitcoin

Decentralization: Bitcoin’s decentralized nature is a core principle distinguishing it from traditional fiat currencies. It is not subject to the control of any central authority, making it resistant to censorship, inflation, and manipulation.

Security Through Cryptography: Bitcoin relies heavily on cryptography for security. Each transaction is encrypted and secured using complex algorithms, making hacking or altering the blockchain difficult.

Transparency and Immutability: All Bitcoin transactions are permanently recorded on the public blockchain, making the system transparent and auditable. It cannot be reversed once a transaction is confirmed, ensuring immutability.

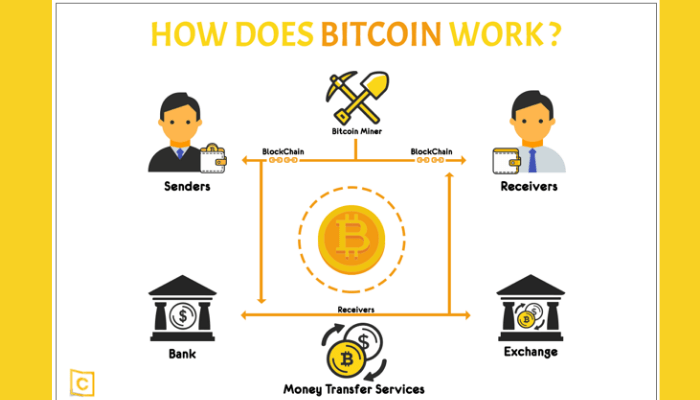

How Does Bitcoin Work?

Bitcoin’s functionality is built upon blockchain technology. Understanding the basics of blockchain is essential to understanding how Bitcoin operates.

Understanding the Basics of Blockchain Technology

The blockchain serves as a distributed ledger, a shared and constantly updated record of transactions. This ledger is not stored in a single location but is replicated across multiple computers, known as “nodes,” within the Bitcoin network. Every node maintains a copy of the blockchain, ensuring its integrity and security.

Bitcoin Mining: Securing the Network

Bitcoin mining is verifying and adding new blocks to the blockchain. Miners are individuals or groups who use powerful computers to solve complex mathematical problems. The first miner to solve the problem gets to add the following block to the blockchain and receives a reward in the form of Bitcoin.

This mining process ensures that the blockchain remains secure and prevents double-spending, where someone attempts to spend the same Bitcoin twice.

Bitcoin Transactions: A Step-by-Step Guide

Bitcoin transactions involve several steps, relying on the blockchain for verification and security.

Bitcoin Wallets and Addresses: To participate in the Bitcoin network, users need a wallet, which acts as a digital container for storing and managing Bitcoins. Each wallet has a unique address, a string of characters that identifies it on the blockchain.

Sending and Receiving Bitcoin: Sending Bitcoin involves transferring coins from one wallet to another. The information is broadcast to the network when a user initiates a transaction. Miners then verify the transaction and add it to a block.

Transaction Fees and Confirmation Times: Bitcoin transactions require a small fee to incentivize miners to process them. The fee varies depending on the network congestion and the speed at which the user wants the transaction confirmed. The transaction is confirmed once a block containing the transaction is added to the blockchain.

Why is Bitcoin Important?

Bitcoin’s significance extends beyond its digital currency. It has the potential to revolutionize financial systems and empower individuals globally.

A New Era of Finance

Challenging Traditional Financial Systems: Bitcoin’s decentralized nature challenges traditional financial institutions, offering an alternative to centralized banking systems. By removing intermediaries, Bitcoin empowers individuals to control their finances with greater autonomy.

Potential for Global Financial Inclusion: Bitcoin can facilitate financial inclusion by providing access to financial services to individuals who may not have traditional bank accounts. It allows for low-cost and cross-border transactions, breaking down geographical barriers to economic participation.

Investment Opportunities and Risks

Understanding Bitcoin’s Volatility: Bitcoin’s price has experienced significant fluctuations and is highly volatile. This volatility stems from market sentiment, regulatory changes, and technological advancements.

Investing Responsibly in the Crypto Market: Investing in Bitcoin involves inherent risks, and it is crucial to understand the potential for price volatility. Investors should conduct thorough research, diversify their portfolios, and only invest what they can afford to lose.

Getting Started with Bitcoin

For those interested in exploring the world of Bitcoin, there are several steps to take to get started.

Choosing a Bitcoin Wallet

The first step is to choose a suitable Bitcoin wallet. Various types of wallets are available, each with features and security considerations.

Different Types of Wallets: Wallets can be categorized based on their functionality, such as software wallets, hardware wallets, and paper wallets. Software wallets are digital wallets that run on a computer or mobile device. Hardware wallets provide enhanced security by storing private keys on a physical device. Paper wallets are printed with a public and private key pair, offering offline storage.

Security Considerations: Choosing a secure wallet is paramount for safeguarding Bitcoins. Consider factors such as the wallet provider’s reputation, the level of encryption used, and the availability of multi-signature capabilities.

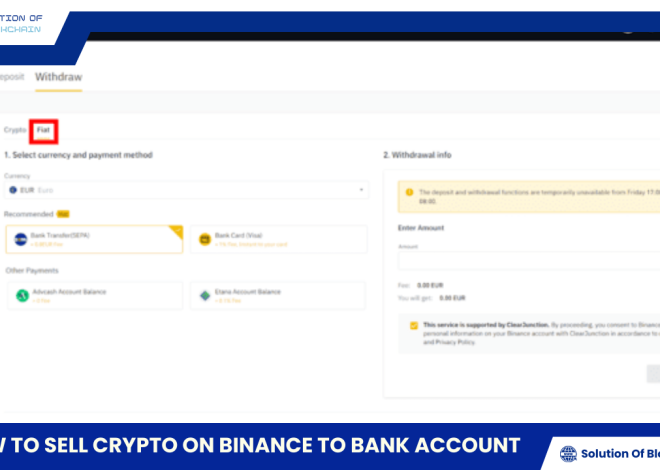

Buying and Selling Bitcoin

To acquire Bitcoins, users can utilize cryptocurrency exchanges or peer-to-peer platforms.

Cryptocurrency Exchanges: Exchanges act as intermediaries facilitating the buying and selling of cryptocurrencies. They offer a variety of trading pairs, allowing users to exchange Bitcoin for fiat currencies or other cryptocurrencies.

Peer-to-Peer Platforms: Peer-to-peer platforms connect buyers and sellers directly without an intermediary. Users can advertise their willingness to buy or sell Bitcoin at a specific price.

So, we’ve explored Bitcoin together – a digital currency that’s revolutionizing the world. Bitcoin operates on blockchain technology, creating a secure and transparent payment system. If you want to delve deeper into Bitcoin and explore other cryptocurrencies, Solution of Blockchain is a reliable resource.