Why is crypto crashing and will it recover

The cryptocurrency market is experiencing a period of strong fluctuations with sudden crashes. Why is crypto crashing and will it recover? Many investors are asking this question. Let’s explore the deep-seated reasons behind the market’s decline and the forecasts for the future of cryptocurrency.

Macroeconomic Factors Impacting Crypto Prices

The Influence of Interest Rates and Inflation on Digital Assets

The global economic landscape plays a significant role in the performance of all assets, including cryptocurrencies. The recent rise in inflation rates, fueled by factors like supply chain disruptions and geopolitical tensions, has led central banks around the world to raise interest rates. This shift towards tighter monetary policies has had a ripple effect on risk assets, with investors becoming more risk-averse and pulling back from speculative investments like crypto.

Regulatory Uncertainty and its Effects on Investor Sentiment

Examining Global Regulatory Landscape and its Impact on Crypto Adoption

Another major factor contributing to crypto’s volatility is the uncertain regulatory landscape surrounding digital assets. Governments worldwide are grappling with how to regulate this nascent asset class, and the lack of clear guidelines and potential for restrictive regulations creates uncertainty for investors. This uncertainty can dampen investor sentiment, leading to increased selling pressure and price volatility.

Can Crypto Recover? Expert Opinions and Market Analysis

The question of whether crypto will recover from its current downturn is a subject of much debate among analysts and industry experts.

Insights from Leading Crypto Analysts and Economists

Bullish vs. Bearish Perspectives on the Future of Cryptocurrencies

Proponents of crypto point to its underlying technology, blockchain, and its potential to revolutionize various industries. They argue that the current downturn is a natural part of a maturing market and that long-term growth prospects for crypto remain strong. Conversely, skeptics express concerns about the speculative nature of crypto, its lack of intrinsic value, and the potential for stricter regulation to stifle its growth.

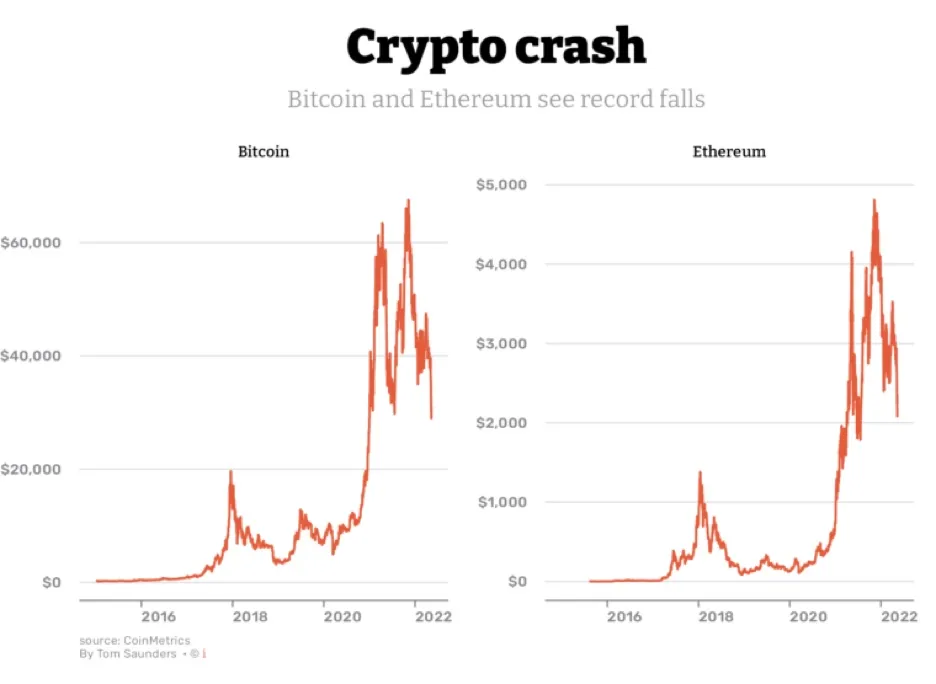

Technical Analysis and Chart Patterns

Identifying Potential Support and Resistance Levels for Key Cryptocurrencies

Technical analysis, which involves studying historical price data and chart patterns, can offer insights into potential future price movements. Analysts look for key support and resistance levels, which can indicate potential buying or selling opportunities. While technical analysis can be a valuable tool, it’s crucial to remember that it’s not foolproof and should be used in conjunction with other forms of analysis.

Navigating the Crypto Crash: Strategies for Investors

For investors navigating the turbulent waters of the crypto market, a measured and informed approach is vital.

Managing Risk in a Volatile Market

The Importance of Diversification and Dollar-Cost Averaging

Diversification, a fundamental principle of investing, involves spreading investments across different asset classes to reduce risk. For crypto investors, this means considering a mix of cryptocurrencies and potentially allocating a portion of their portfolio to more traditional assets. Dollar-cost averaging is another strategy that can help mitigate risk in volatile markets. It involves investing a fixed amount of money at regular intervals, regardless of the asset’s price, which can average out the cost of investment over time.

Long-Term Investment Strategies for Crypto

Identifying Promising Projects and Understanding Tokenomics

Investing in crypto requires thorough research and an understanding of the underlying technology and market dynamics. It’s crucial to evaluate projects based on their potential real-world applications, the strength of their development team, and the tokenomics, which refers to the token’s distribution and economic model.

Security is paramount in the crypto space. It’s crucial to store crypto assets securely, using hardware wallets or reputable custodial services, and to be vigilant against phishing scams and other security threats.

So, we have together analyzed the main reasons leading to the decline of the cryptocurrency market. However, whether the market can recover and develop sustainably depends on many other factors. For a more comprehensive view of the future of the cryptocurrency market, you can refer to more in-depth analysis articles on Solution of Blockchain.