Bitcoin’s Market Fluctuations: What is Bitcoin’s current value

Bitcoin, the world’s leading cryptocurrency, is always the focus of investors. What is bitcoin’s current value? Will it continue to grow or will there be adjustments? Let’s explore the factors affecting Bitcoin’s price and the latest forecasts about the trend of this cryptocurrency

Bitcoin’s Current Value: A Snapshot of the Market

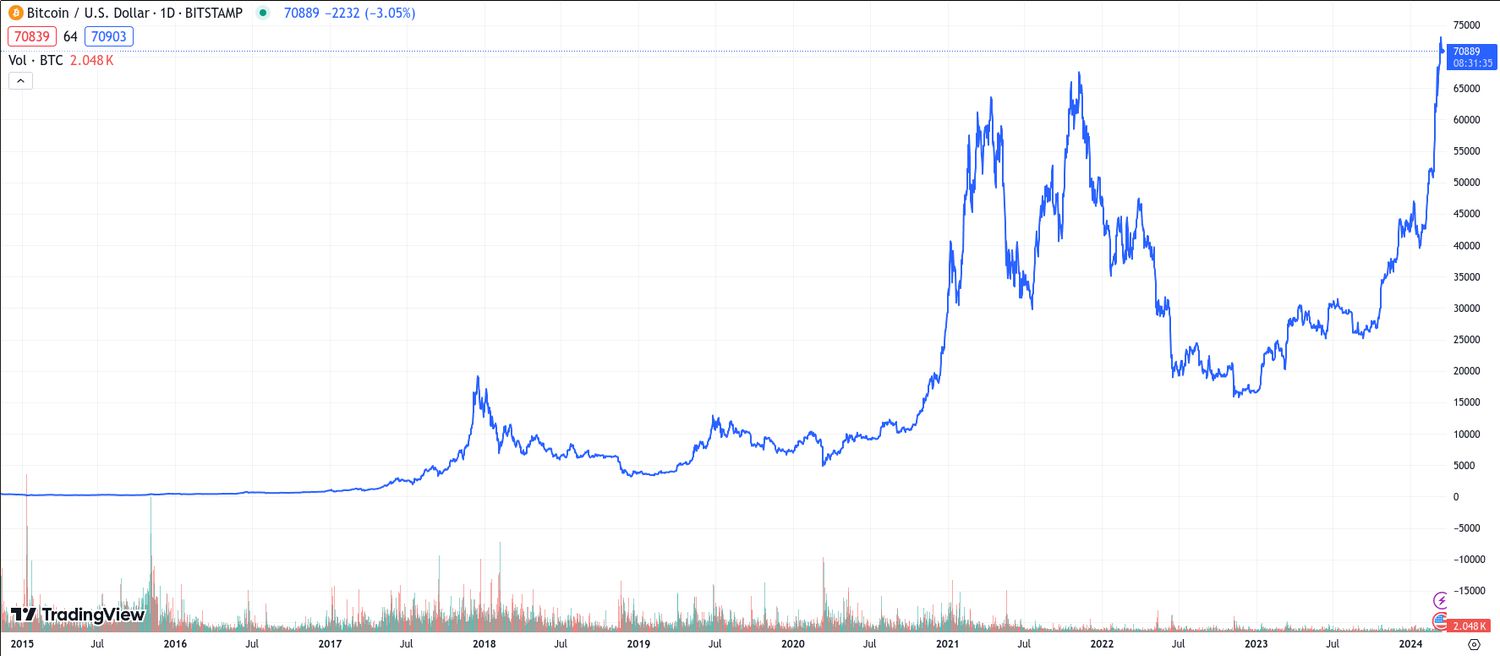

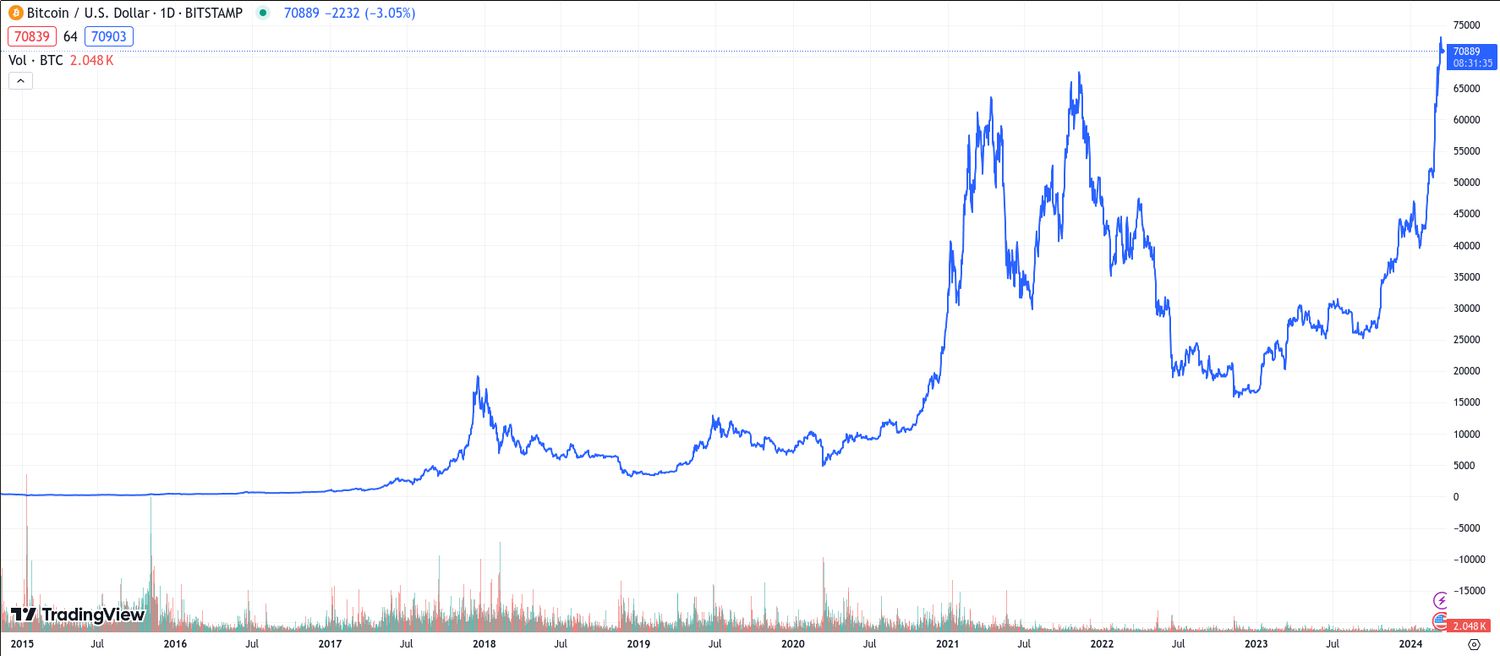

Live Tracking and Historical Data

In the fast-paced world of cryptocurrency, Bitcoin’s price is in constant flux, reflecting the dynamic interplay of supply and demand, market sentiment, and other factors. Investors and enthusiasts rely on live tracking tools and historical data analysis to understand Bitcoin’s current value, providing valuable insights into the cryptocurrency’s performance.

Reputable Sources for Real-Time Bitcoin Prices

Numerous platforms offer real-time Bitcoin price updates, often with customizable charts and graphs to visualize price movements over different timeframes. Reputable cryptocurrency exchanges, financial news websites, and dedicated market tracking websites are reliable sources for obtaining this information. Investors are encouraged to cross-reference data from multiple sources to ensure accuracy.

Analyzing Bitcoin’s Price History: Trends and Volatility

Examining Bitcoin’s historical price data reveals a pattern of significant price swings and periods of rapid growth and sharp decline. This volatility is inherent to the cryptocurrency market and is influenced by factors such as investor speculation, regulatory announcements, and technological advancements. By studying historical trends, investors can better understand Bitcoin’s price behavior and make more informed investment decisions.

Why is Bitcoin’s Value Fluctuating?

Unveiling the Forces Behind the Price Swings

Bitcoin’s price volatility stems from a complex interplay of factors, reflecting the cryptocurrency market’s nascent and evolving nature. Understanding these drivers is crucial for navigating the often unpredictable terrain of Bitcoin investing.

Market Sentiment and News Events

Investor psychology plays a significant role in shaping Bitcoin’s price movements. Positive news, such as wider adoption by mainstream companies or favorable regulatory developments, can trigger a surge in demand and drive the price upward. Conversely, negative news, like security breaches or government crackdowns, can fuel fear and uncertainty, leading to sell-offs and price drops.

Regulatory Developments and Government Policies

The regulatory landscape for cryptocurrencies remains in flux, with governments worldwide grappling with how to classify and oversee these digital assets. Announcements of new regulations or changes to existing ones can profoundly impact Bitcoin’s price. For instance, stricter regulations often raise concerns about market accessibility, potentially dampening investor enthusiasm.

Supply and Demand Dynamics: Bitcoin’s Limited Supply

Bitcoin’s finite supply, capped at 21 million coins, is a fundamental factor influencing its price. As demand for Bitcoin increases and the available supply diminishes, the scarcity principle comes into play, potentially exerting upward pressure on its value. This contrasts with traditional fiat currencies, where central banks can adjust the money supply, potentially influencing inflation rates.

Is Bitcoin a Good Investment?

Weighing the Risks and Rewards

Investing in Bitcoin presents both significant potential rewards and inherent risks. It is crucial for potential investors to carefully weigh these factors, conduct thorough research, and consider their own financial circumstances and risk tolerance before making any investment decisions.

Potential for High Returns vs. Market Volatility

Bitcoin’s history is marked by periods of exceptional returns, attracting investors seeking to capitalize on its growth potential. However, its price volatility can result in substantial losses, particularly for those engaging in short-term speculation or leveraged trading. A long-term investment horizon and a deep understanding of market cycles are essential.

Long-Term Growth Potential vs. Short-Term Speculation

While some investors view Bitcoin as a long-term store of value, akin to digital gold, others engage in short-term trading, aiming to profit from price fluctuations. Bitcoin’s long-term growth potential hinges on factors such as wider adoption, technological advancements, and the regulatory landscape.

Diversifying Your Investment Portfolio: Bitcoin’s Role

Diversification remains a cornerstone of prudent investing. With its unique characteristics and growth potential, Bitcoin can play a role in a well-diversified portfolio. However, it is essential to allocate investments strategically, considering factors such as risk tolerance and financial goals.

Investors always focus on the current value of Bitcoin. The strong fluctuations in Bitcoin’s price make many curious and worried. To make wise investment decisions, you must understand the factors affecting Bitcoin’s price, such as macroeconomic conditions, government policies, and investor sentiment. Always remember that the cryptocurrency market is always risky. Investing in Bitcoin requires extensive knowledge, patience, and a clear investment plan. Visit Solution Of Blockchain to learn more