How many Bitcoins are left to mine. Unlocking Bitcoin’s Scarcity

With its limited supply, Bitcoin has always been the focus of investors. But do you know that the amount of Bitcoin yet to be mined is decreasing? Let’s explore why Bitcoin has a limited supply and how many bitcoins are left to mine.

How Many Bitcoins Are Left to Mine?

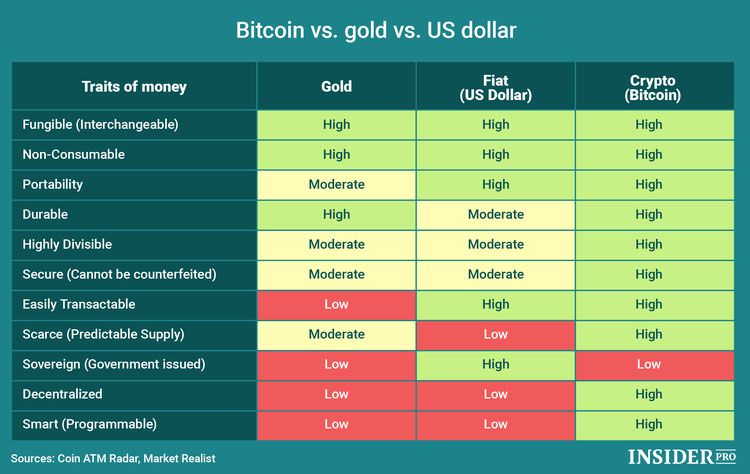

To understand this, we must first delve into the concept of Bitcoin’s finite supply. Unlike traditional currencies governments can print, Bitcoin has a predetermined maximum supply of 21 million coins. This hard cap is ingrained in Bitcoin’s underlying code and is a fundamental aspect of its design.

Understanding Bitcoin’s Finite Supply

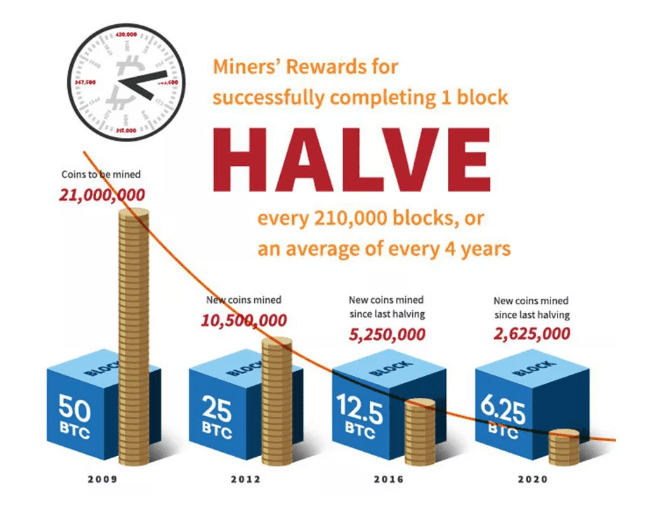

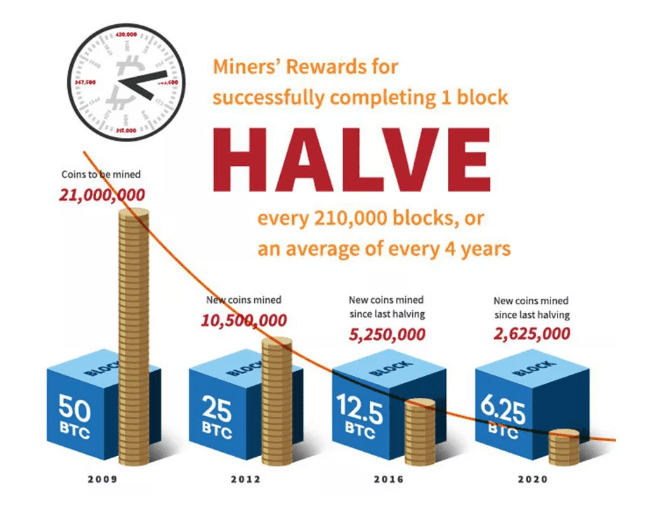

Bitcoin halving is a pre-programmed event that occurs approximately every four years. During a halving, the reward that miners receive for adding new blocks to the Bitcoin blockchain is cut in half. This mechanism controls the rate at which new Bitcoins are created and ensures a gradual and controlled approach to reaching the maximum supply.

The decision to limit Bitcoin’s supply was intentional and aimed at mimicking the scarcity of precious metals like gold. By creating a finite supply, Bitcoin’s creators sought to introduce a deflationary model, contrasting with the inflationary nature of fiat currencies, which tend to lose value over time due to factors like government printing.

The Current State of Bitcoin Mining

As of today, a significant portion of Bitcoins has already been mined. Each block added to the blockchain initially yielded a reward of 50 Bitcoins. However, due to the halving events, this reward has been reduced to 6.25 Bitcoins per block.

How many Bitcoins have been mined already?

The current number of Bitcoins in circulation fluctuates slightly due to the continuous mining process. However, it’s estimated that over 19 million Bitcoins have already been mined, leaving less than 2 million yet to be unearthed.

Bitcoin halving events directly impact the profitability of mining. When the block reward is halved, miners earn less Bitcoin for the same amount of computational power expended. This can lead to a shift in the mining landscape, with less efficient miners potentially finding it unprofitable to continue operations.

When Will the Last Bitcoin Be Mined?

Predicting the exact date when the last Bitcoin will be mined is challenging due to various factors influencing the process.

Factors influencing the timeline

The Bitcoin network automatically adjusts the difficulty of mining every 2016 blocks, approximately every two weeks. This adjustment ensures that the time taken to mine a block remains relatively consistent, regardless of the total computational power dedicated to mining.

The hash rate, a measure of the computational power dedicated to mining Bitcoin, is another crucial factor. A higher hash rate generally leads to faster block discovery, but it also increases mining difficulty, balancing the equation.

While the exact date remains uncertain, most estimations suggest that the last Bitcoin will likely be mined sometime around the year 2140.

What Happens After All Bitcoins Are Mined?

The prospect of all Bitcoins being mined raises questions about the future of the Bitcoin ecosystem.

The Future of Bitcoin’s Ecosystem.

Once all Bitcoins are mined, miners will no longer receive block rewards as an incentive. Instead, they will rely solely on transaction fees paid by users to include their transactions in the blockchain.

A critical question is whether transaction fees alone will be sufficient to incentivize miners to secure the network. If the rewards are not deemed lucrative enough, it could theoretically lead to a decline in mining participation, potentially impacting the network’s security.

The future of Bitcoin after all coins are mined remains a subject of debate and speculation. However, the finite supply, a defining feature of Bitcoin, will undoubtedly continue to shape its journey in the years to come.

The limitation of Bitcoin’s total supply to 21 million coins is one of the key factors that make Bitcoin attractive. As the remaining amount of Bitcoin decreases, the value of each Bitcoin tends to increase. However, this also means that the competition to mine Bitcoin will become more fierce. Understanding the mining mechanism and the remaining amount of Bitcoin will help you make more informed investment decisions. For more information, please refer to the Solution Of Blockchain website